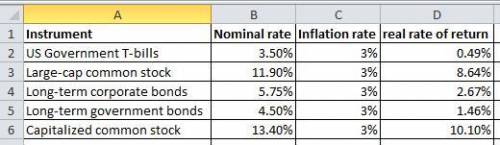

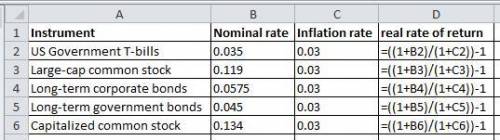

Business, 20.09.2020 16:01, tntaylor862

You are given the following long-run annual rates of return for alternative investment instruments: U. S. Government T-bills 3.50 % Large-cap common stock 11.90 Long-term corporate bonds 5.75 Long-term government bonds 4.50 Small-capitalization common stock 13.40 The annual rate of inflation during this period was 3 percent. Compute the real rate of return on these investment alternatives. Do not round intermediate calculations. Round your answers to two decimal places. Real Rate of Return U. S. Government T-bills: % Large-cap common stock: % Long-term corporate bonds: % Long-term government bonds: % Small-capitalization common stock: %

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 17:00, jaymoney0531

Can someone me ? i’ll mark the best answer brainliest : )

Answers: 1

Business, 22.06.2019 20:10, hsbhxsb

Your sister is thinking about starting a new business. the company would require $375,000 of assets, and it would be financed entirely with common stock. she will go forward only if she thinks the firm can provide a 13.5% return on the invested capital, which means that the firm must have an roe of 13.5%. how much net income must be expected to warrant starting the business? a. $41,234b. $43,405c. $45,689d. $48,094e. $50,625

Answers: 3

Business, 23.06.2019 00:00, JayceMeyers06

The undress company produces a dress that women use to quickly and easily change in public. the company is just over a year old and has been successful through a kickstarter campaign. the undress company has identified a customer segment, but if it wants to reach a larger customer segment market outside of the kickstarter family, what question must it answer?

Answers: 1

Do you know the correct answer?

You are given the following long-run annual rates of return for alternative investment instruments:...

Questions in other subjects:

Mathematics, 29.08.2019 23:40

Mathematics, 29.08.2019 23:40

English, 29.08.2019 23:40

History, 29.08.2019 23:40

Mathematics, 29.08.2019 23:40