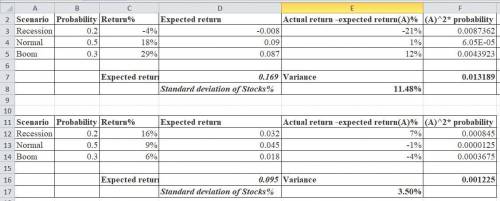

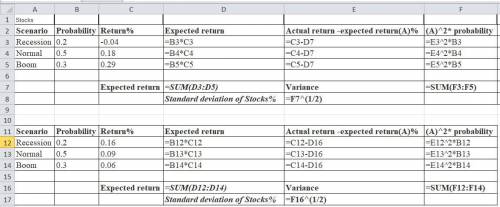

Consider the following scenario analysis:Rate of Return Scenario Probability Stocks BondsRecession 0.20 -4 % 16 %Normal economy 0.50 18 % 9 %Boom 0.30 29 % 6 %a. Is it reasonable to assume that Treasury bonds will provide higher returns in recessions than in booms?b. Calculate the expected rate of return and standard deviation for each investment. c. Which investment would you prefer?

Answers: 2

Other questions on the subject: Business

Business, 21.06.2019 20:30, marklynr9955

Resources that are valuable but not rare can be categorized asanswers: organizational weaknesses. distinctive competencies. organizational strengths. complementary resources and capabilities.

Answers: 1

Business, 22.06.2019 00:20, brainbean

Suppose that the world price of steel is $100 a ton, india does not trade internationally, and the equilibrium price of steel in india is $60 a ton. suppose that india now begins to trade internationally. the price of steel in india the quantity of steel produced in india a. does not change; does not change b. falls; increases c. falls; decreases d. rises; decreases e. rises; increases the quantity of steel bought by india india steel. a. increases; exports b. decreases; imports c. decreases; exports d. does not change; neither imports nor exports e. increases; imports

Answers: 2

Business, 22.06.2019 05:30, 2023greenlanden

The hartman family is saving $400 monthly for ronald's college education. the family anticipates they will need to contribute $20,000 towards his first year of college, which is in 4 years .which best explain s whether the family will have enough money in 4 years ?

Answers: 1

Business, 22.06.2019 11:00, roseemariehunter12

In each of the following cases, find the unknown variable. ignore taxes. (do not round intermediate calculations and round your answers to the nearest whole number, e. g., 32.) accounting unit price unit variable cost fixed costs depreciation break-even 20,500 $ 44 $ 24 $ 275,000 $ 133,500 44 4,400,000 940,000 8,000 75 320,000 80,000

Answers: 3

Do you know the correct answer?

Consider the following scenario analysis:Rate of Return Scenario Probability Stocks BondsRecession 0...

Questions in other subjects:

Mathematics, 07.07.2021 23:00

Mathematics, 07.07.2021 23:10

Mathematics, 07.07.2021 23:10

Mathematics, 07.07.2021 23:10

Health, 07.07.2021 23:10