Business, 03.09.2020 06:01, boyettalexandra

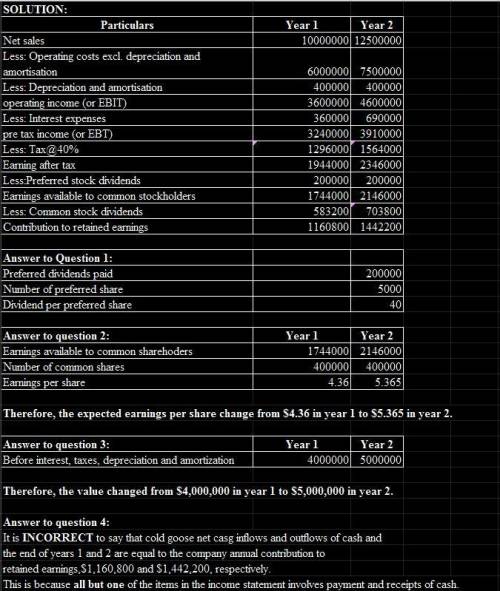

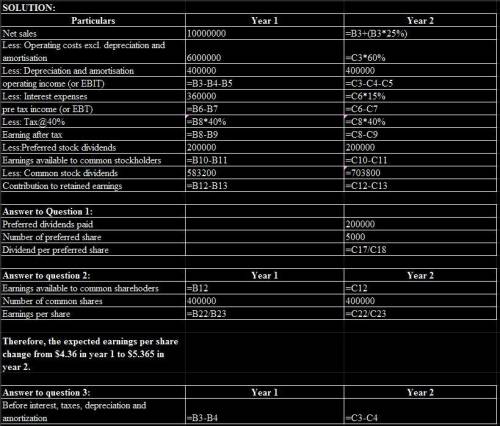

The income statement, also known as a profit and loss (P&L) statement, provides a snapshot of a company's financial performance during a specified period of time. It reports a firm's gross income, expenses, net income, and the income that is available for distribution to its preferred and common shareholders. The income statement is prepared using the generally accepted accounting principles (GAAP) that match the firm's revenues and expenses to the period in which they are incurred, not necessarily when cash is received or paid. Investors and analysts use the information presented in the income statement, and the other financial statements and reports, to evaluate the company's financial performance and condition Consider the following scenario: Green Caterpillar Garden Supplies Inc.'s income statement reports data for its first year of operation. The firm's CEO would like sales to increase by 25% next year. 1. Green Caterpillar is able to achieve this level of increased sales, but its interest costs increase from 10% to 15% of earnings before interest and taxes (EBIT). 2. The company's operating costs (excluding depreciation and amortization) remain at 70.00% of net sales, and its depreciation and amortization expenses remain constant from year to year. 3. The company's tax rate remains constant at 40% of its pre-tax income or earnings before taxes (EBT). 4. In Year 2, Green Caterpillar expects to pay $100,000 and $896,963 of preferred and common stock dividends, respectively. Complete the Year 2 income statement data for Green Caterpillar, then answer the questions that follow. Round each dollar value to the nearest whole dollar. Green Caterpillar Garden Supplies Inc. Income Statement for Year Ending December 31 Year 1 Year 2 (Forecasted) $15,000,000 10,500,000 600,000 600,000 $3,900,000 390,000 Net sales Less: Operating costs, except depreciation and amortization Less: Depreciation and amortization expenses Operating income (or EBIT) Less: Interest expense Pre-tax income (or EBT) Less: Taxes (40%) Earnings after taxes Less: Preferred stock dividends Earnings available to common shareholders Less: Common stock dividends Contribution to retained earnings $3,510,000 1,404,000 $2,106,000 100,000 $2,006,000 737,100 $1,109,037 $1,565,787 Given the results of the previous income statement calculations, complete the following statements:Given the results of the previous income statement calculations, complete the following statements: • In Year 2, if Green Caterpillar has 10,000 shares of preferred stock issued and outstanding, then each preferred share should expect to receive in annual dividends. • If Green Caterpillar has 500,000 shares of common stock issued and outstanding, then the firm's earnings per share (EPS) is expected to change from in Year 1 to in Year 2 • Green Caterpillar's before interest, taxes, depreciation and amortization (EBITDA) value changed from in Year 1 to in Year 2. • It is to say that Green Caterpillar's net inflows and outflows of cash at the end of Years 1 and 2 are equal to the company's annual contribution to retained earnings, $1,109,037 and $1,565,787, respectively. This is because of the items reported in the income statement involve payments and receipts of cash.

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 17:00, justyne2004

Afinancing project has an initial cash inflow of $42,000 and cash flows of −$15,600, −$22,200, and −$18,000 for years 1 to 3, respectively. the required rate of return is 13 percent. what is the internal rate of return? should the project be accepted?

Answers: 1

Business, 22.06.2019 19:00, eraines1714

Which of the following is likely not a benefit of requiring a grand jury to listen to and examine all of the evidence against a person suspected of committing a serious crime and then independently deciding whether or not to hand down an indictment? 1.the grand jury system provides the accused another safeguard against being sent to trial and facing conviction based on flawed evidence. 2.the members of the grand jury are drawn from the community and are empowered to render independent decisions about whether or not the government has collected enough evidence to bring an individual to trial. 3.the grand jury’s decision can provide prosecutors insight into what is necessary to build a sufficient case if a similar crime is presented later. 4.the grand jury is impaneled to rubber-stamp prosecutors’ cases, which makes it possible for more cases to reach trial.

Answers: 2

Business, 22.06.2019 19:30, dominickstrickland

Kirnon clinic uses client-visits as its measure of activity. during july, the clinic budgeted for 3,250 client-visits, but its actual level of activity was 3,160 client-visits. the clinic has provided the following data concerning the formulas to be used in its budgeting: fixed element per month variable element per client-visitrevenue - $ 39.10personnel expenses $ 35,100 $ 10.30medical supplies 1,100 7.10occupancy expenses 8,100 1.10administrative expenses 5,100 0.20total expenses $ 49,400 $ 18.70the activity variance for net operating income in july would be closest to:

Answers: 1

Business, 22.06.2019 20:00, hunter3978

Assume the perpetual inventory method is used. 1) the company purchased $12,500 of merchandise on account under terms 2/10, n/30. 2) the company returned $1,200 of merchandise to the supplier before payment was made. 3) the liability was paid within the discount period. 4) all of the merchandise purchased was sold for $18,800 cash. what effect will the return of merchandise to the supplier have on the accounting equation?

Answers: 2

Do you know the correct answer?

The income statement, also known as a profit and loss (P&L) statement, provides a snapshot of a...

Questions in other subjects:

Arts, 18.12.2019 01:31

Chemistry, 18.12.2019 01:31

Mathematics, 18.12.2019 01:31

History, 18.12.2019 01:31

World Languages, 18.12.2019 01:31

English, 18.12.2019 01:31

Mathematics, 18.12.2019 01:31