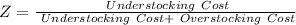

(Chemical Manufacturing) A chemical manufacturer produces a certain chemical compound every Sunday, which it then sells to its customers on Monday through Saturday. The company earns a revenue of $80 per kg of the compound sold. Each kg manufactured costs the company $40. If any of the compound goes unsold by Saturday night, it must be destroyed safely, at a cost of $15 per kg. The total demand for the chemical compound throughout the week has a normal distribution with a mean of 260 kg and a standard deviation of 80 kg. a) How much of the chemical compound should the company produce every Sunday?b) What is the expected cost (including manufacturing cost, lost profit, and disposal cost) per week?

Answers: 2

Other questions on the subject: Business

Business, 21.06.2019 19:50, Taiyou

The u. s. stock market has returned an average of about 9% per year since 1900. this return works out to a real return (i. e., adjusted for inflation) of approximately 6% per year. if you invest $100,000 and you earn 6% a year on it, how much real purchasing power will you have in 30 years?

Answers: 2

Business, 22.06.2019 02:20, unicornsflyhigh

Each month, business today publishes a news piece about an innovative product, service, or business. such soft news is generally written by a freelance business writer and is known as a

Answers: 2

Business, 22.06.2019 04:00, 702580

Medtronic, inc., is a medical technology company that competes for customers with st. jude medical s. c., inc. james hughes worked for medtronic as a sales manager. his contract prohibited him from working for a competitor for one year after leaving medtronic. hughes sought a position as a sales director for st. jude. st. jude told hughes that his contract with medtronic was unenforceable and offered him a job. hughes accepted. medtronic filed a suit, alleging wrongful interference. which type of interference was most likely the basis for this suit? did it occur here? medtronic, inc., is a medical technology company that competes for customers with st. jude medical s. c., inc. james hughes worked for medtronic as a sales manager. his contract prohibited him from working for a competitor for one year after leaving medtronic

Answers: 2

Business, 22.06.2019 13:10, Mikey3414

Trey morgan is an employee who is paid monthly. for the month of january of the current year, he earned a total of $4,538. the fica tax for social security is 6.2% of the first $118,500 earned each calendar year, and the fica tax rate for medicare is 1.45% of all earnings for both the employee and the employer. the amount of federal income tax withheld from his earnings was $680.70. his net pay for the month is .

Answers: 1

Do you know the correct answer?

(Chemical Manufacturing) A chemical manufacturer produces a certain chemical compound every Sunday,...

Questions in other subjects:

History, 24.02.2020 18:18

(

( = average demand, Z = normal distribution score, and

= average demand, Z = normal distribution score, and  = standard deviation).

= standard deviation).