Business, 31.08.2020 01:01, carlyfaith3375

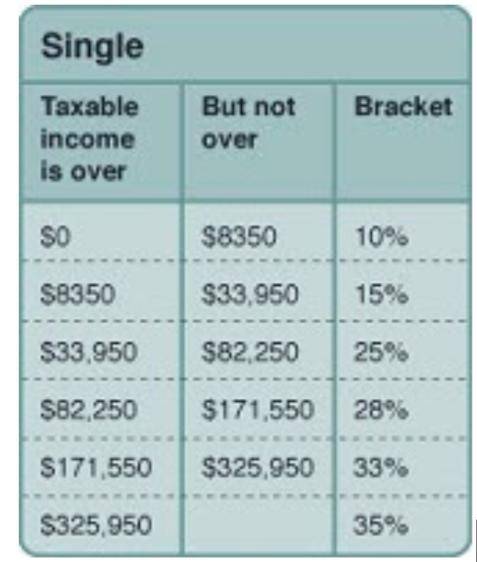

Lewis is single, and he is trying to decide whether to contribute $5000 to a traditional IRA or to a Roth IRA. His taxable income is currently $94,000 per year, and he expects it to be $190,000 per year when he takes his money out of his IRA. He also expects his $5000 investment to triple in value by the time he takes his money out. Use this information and the tax table below to assist Lewis in making his decision. Assume that current tax brackets will stay the same by the time Lewis takes his money out of his IRA

Part I: If Lewis chooses a traditional IRA, how much will he pay in taxes now on the $5000?

Part II: If Lewis chooses a traditional IRA, how much will he pay in taxes when he takes the $5000 and the earnings on the $5000 out of his IRA?

Part III: If Lewis chooses a Roth IRA, how much will he pay in taxes now on the $5000?

Part IV: If Lewis chooses a Roth IRA, how much will he pay in taxes when he takes the $5000 and the earnings on the $5000 out of his IRA?

Part V: Will choosing a traditional IRA or a Roth IRA cause Lewis to pay more in taxes? How much more will Lewis pay?

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 04:40, glenn4572

Select the correct text in the passage. which sentences in the given passage explains the limitations of monetary policies? monetary policies - limitationsmonetary policies are set by the central bank to bring about growth in the economy. de can be achieved these policiesw at anden i sca poit would be fair to say that changes in the economy cannot be brought about instantly by monetary po des. monetary policy can only influence not control, economic growththe monetary policy makers do work on sining the perfect balance between demand and supply of money in the economy

Answers: 3

Business, 22.06.2019 17:00, HourlongNine342

Serious question, which is preferred in a business? pp or poopoo?

Answers: 1

Business, 22.06.2019 19:30, livimal77

At december 31, 2016, pina corporation had the following stock outstanding. 10% cumulative preferred stock, $100 par, 107,810 shares $10,781,000 common stock, $5 par, 4,026,000 shares 20,130,000 during 2017, pina did not issue any additional common stock. the following also occurred during 2017. income from continuing operations before taxes $21,950,000 discontinued operations (loss before taxes) $3,505,000 preferred dividends declared $1,078,100 common dividends declared $2,300,000 effective tax rate 35 % compute earnings per share data as it should appear in the 2017 income statement of pina corporation

Answers: 1

Business, 23.06.2019 02:30, winterblanco

How is the role of government determined in the american free enterprise system?

Answers: 2

Do you know the correct answer?

Lewis is single, and he is trying to decide whether to contribute $5000 to a traditional IRA or to a...

Questions in other subjects:

Chemistry, 22.08.2019 03:00

Spanish, 22.08.2019 03:00

History, 22.08.2019 03:00

Physics, 22.08.2019 03:00

Mathematics, 22.08.2019 03:00

Mathematics, 22.08.2019 03:00

Mathematics, 22.08.2019 03:00

World Languages, 22.08.2019 03:00

Chemistry, 22.08.2019 03:00