Business, 27.08.2020 01:01, gizmo50245

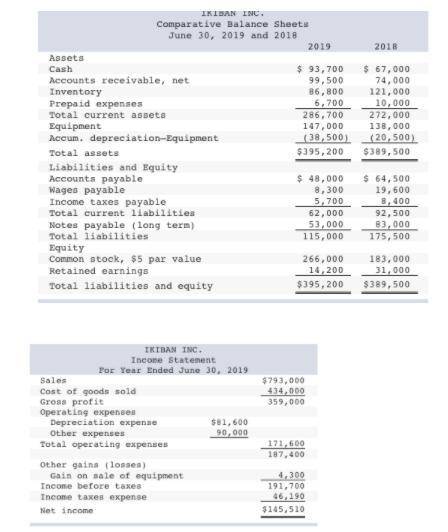

Prepare a statement of cash flows using the indirect method for the year ended June 30, 2019. (Amounts to be deducted should be indicated with a minus sign.) IKIBAN, INC. Statement of Cash Flows (Indirect Method) For Year Ended June 30, 2019 Cash flows from operating activities Adjustments to reconcile net income to net cash provided by operating activities Income statement items not affecting cash Changes in current operating assets and liabilities Cash flows from investing activities Cash flows from financing activities Net increase (decrease) in cash Cash balance at prior year-end Cash balance at current year-end IKIBAN INC. Comparative Balance Sheets June 30, 2019 and 2018 2018 2019 Assets 93,700 $67,000 Cash Accounts receivable, net 99,500 86,800 6,700 74,000 121,000 Inventory Prepaid expenses 10,000 272,000 138,000 Total current assets 286,700 147,000 Equipment Accum. depreciation-Equipment (38,500) (20,500) $395,200 $389,500 Total assets Liabilities and Equity Accounts payable Wages payable Income taxes payable $48,000 $64,500 8,300 5,700 19,600 8,400 Total current liabilities 62,000 92,500 Notes payable (long term) Total liabilities 53,000 115,000 83,000 175,500 Equity Common stock, $5 par value Retained earnings 266,000 183,000 31,000 14,200 Total liabilities and equity $395,200 $389,500 IKIBAN INC Income Statement For Year Ended June 30, 2019 Sales $793,000 434,000 359,000 Cost of goods sold Gross profit Operating expenses Depreciation expense $81,600 Other expenses 90,000 Total operating expenses 171,600 187,400 other gains (losses) Gain on sale of equipment 4,300 Income before taxes 191,700 46,190 Income taxes expense $145,510 Net income Additional Information a. A $30,000 note payable is retired at its $30,000 carrying (book) value in exchange for cash. b. The only changes affecting retained earnings are net income and cash dividends paid. c. New equipment is acquired for $80,600 cash. d. Received cash for the sale of equipment that had cost $71,600, yielding a $4,300 gain e. Prepaid Expenses and Wages Payable relate to Other Expenses on the income statement. f. All purchases and sales of inventory are on credit.

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 09:50, thanitoast84

Acar manufacturer uses new machines that automatically assemble an engine from parts fed to the system. the machine can regulate the speed ofassembly depending on the number of parts produced. which type of technology does this machine use? angenoem mense wat ons in matin en esta va ser elthe machine uses

Answers: 3

Business, 22.06.2019 19:40, cieloromero1

Moody corporation uses a job-order costing system with a plantwide predetermined overhead rate based on machine-hours. at the beginning of the year, the company made the following estimates: machine-hours required to support estimated production 100,000 fixed manufacturing overhead cost $ 650,000 variable manufacturing overhead cost per machine-hour $ 3.00 required: 1. compute the plantwide predetermined overhead rate. 2. during the year, job 400 was started and completed. the following information was available with respect to this job: direct materials $ 450 direct labor cost $ 210 machine-hours used 40

Answers: 3

Business, 22.06.2019 23:30, hehefjf3854

Miller company’s total sales are $171,000. the company’s direct labor cost is $20,520, which represents 30% of its total conversion cost and 40% of its total prime cost. its total selling and administrative expense is $25,650 and its only variable selling and administrative expense is a sales commission of 5% of sales. the company maintains no beginning or ending inventories and its manufacturing overhead costs are entirely fixed costs. required: 1. what is the total manufacturing overhead cost? 2. what is the total direct materials cost? 3. what is the total manufacturing cost? 4. what is the total variable selling and administrative cost? 5. what is the total variable cost? 6. what is the total fixed cost? 7. what is the total contribution margin?

Answers: 3

Do you know the correct answer?

Prepare a statement of cash flows using the indirect method for the year ended June 30, 2019. (Amoun...

Questions in other subjects:

History, 19.08.2020 17:01

Biology, 19.08.2020 17:01

Mathematics, 19.08.2020 17:01

Mathematics, 19.08.2020 17:01