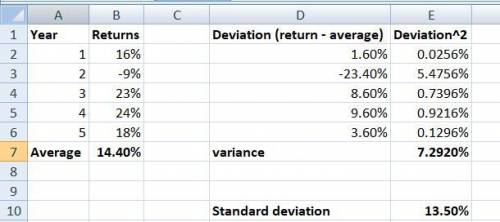

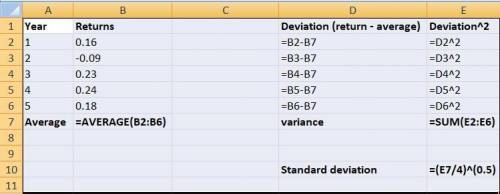

You find a certain stock that had returns of 16 percent, −9 percent, 23 percent, and 24 percent for four of the last five years. The average return of the stock over this period was 14.4 percent. a. What was the stock’s return for the missing year? (Do not round intermediate calculations and enter your answer as a percent rounded to 1 decimal place, e. g., 32.1.) b. What is the standard deviation of the stock’s returns? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e. g., 32.16.)

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 15:20, Chrisis9987

The beginning inventory is expected to be 2,000 cases. expected sales are 10,000 cases, and the company wishes to begin the next period with an inventory of 1,000 cases. the number of cases the company must purchase during the month is multiple choice 9,000 cases. 10,000 cases. 11,000 cases. 13,000 cases.

Answers: 1

Business, 21.06.2019 21:30, dontcareanyonemo

Peninsula products has just applied for a loan at your bank. when reviewing peninsula's books for the year that just ended, you notice that the firm uses the fair value option for its bonds payable. you also see that the firm recorded a $55,000 debit in its bonds payable account and a $55,000 credit in its unrealized holding gain or loss"income account. over that same period, interest rates decreased by about 0.5 percent. how should this information affect the bank's decision as to whether to grant peninsula a loan? a : the bank should strongly consider giving a loan to peninsula because the changes in firm's bonds payable and unrealized holding gain or loss"income accounts suggest that peninsula has seen an increase in its credit rating over the past year. b : the bank should put little emphasis on the changes in peninsula's bonds payable and unrealized holding gain or loss"income accounts because these changes are likely the result of the rise in interest rates. c : the bank should hesitate before giving a loan to peninsula because the changes in firm's bonds payable and unrealized holding gain or loss"income accounts suggest that peninsula has seen a decline in its credit rating over the past year. d : the bank should put little emphasis on the changes in peninsula's bonds payable and unrealized holding gain or loss"income accounts because these changes are likely unrelated to either interest rates or the firm's credit rating.

Answers: 2

Business, 22.06.2019 12:30, cuppykittyy

Acorporation a. can use different depreciation methods for tax and financial reporting purposes b. must use the straight - line depreciation method for tax purposes and double declining depreciation method financial reporting purposes c. must use different depreciation method for tax purposes, but strictly mandated depreciation methods for financial reporting purposes d. can use straight- line depreciation method for tax purposes and macrs depreciation method financial reporting purposes

Answers: 2

Business, 22.06.2019 19:00, mairadua14

12. to produce a textured purée, you would use a/an a. food processor. b. wide-mesh sieve. c. immersion blender d. food mill.

Answers: 1

Do you know the correct answer?

You find a certain stock that had returns of 16 percent, −9 percent, 23 percent, and 24 percent for...

Questions in other subjects:

History, 23.08.2019 15:30

Health, 23.08.2019 15:30

Mathematics, 23.08.2019 15:30

English, 23.08.2019 15:30

History, 23.08.2019 15:30