Business, 23.08.2020 14:01, daartist3121

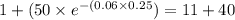

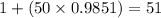

A stock is selling at $40, a 3-month put at $50 is selling for $11, a 3-month call at $50 is selling for $1, and the risk-free rate is 6%.How much, if anything, can be made on an arbitrage?

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 19:10, crzyemo865

Calculating and interpreting eps information wells fargo reports the following information in its 2015 form 10-k. in millions 2015 2014 wells fargo net income $24,005 $24,168 preferred stock dividends $1,535 $1,347 common stock dividends $7,400 $6,908 average common shares outstanding 5,136.5 5,237.2 diluted average common shares outstanding 5,209.8 5,324.4 determine wells fargo's basic eps for fiscal 2015 and for fiscal 2014. round answers to two decimal places.

Answers: 3

Business, 22.06.2019 20:20, korireidkdotdot82021

Which of the following entries would be made to record the requisition of $12,000 of direct materials and $6,900 of indirect materials? (assume that indirect materials are included in raw materials inventory.) a. manufacturing overhead 18,900 raw materials inventory 18,900 b. wip inventory 12,000 manufacturing overhead 6,900 raw materials inventory 18,900 c. raw materials inventory 18,900 wip inventory 18,900 d. wip inventory 18,900 raw materials inventory 18,900

Answers: 1

Business, 23.06.2019 02:10, Thejollyhellhound20

Make or buy eastside company incurs a total cost of $120,000 in producing 10,000 units of a component needed in the assembly of its major product. the component can be purchased from an outside supplier for $11 per unit. a related cost study indicates that the total cost of the component includes fixed costs equal to 50% of the variable costs involved. a. should eastside buy the component if it cannot otherwise use the released capacity? present your answer in the form of differential analysis. use negative sign represent a net disadvantage answer; otherwise do not use negative signs with your answers. cost from outside supplier $answer variable costs avoided by purchasing answer net advantage (disadvantage) to purchase alternative $answer b. what would be your answer to requirement (a) if the released capacity could be used in a project that would generate $50,000 of contribution margin? use negative sign represent a net disadvantage answer; otherwise do not use negative signs with your answers.

Answers: 2

Do you know the correct answer?

A stock is selling at $40, a 3-month put at $50 is selling for $11, a 3-month call at $50 is selling...

Questions in other subjects:

= $40

= $40 = $11

= $11 = $1

= $1