During the first month of operations, Wortham Services, Inc., completed the following transactions:

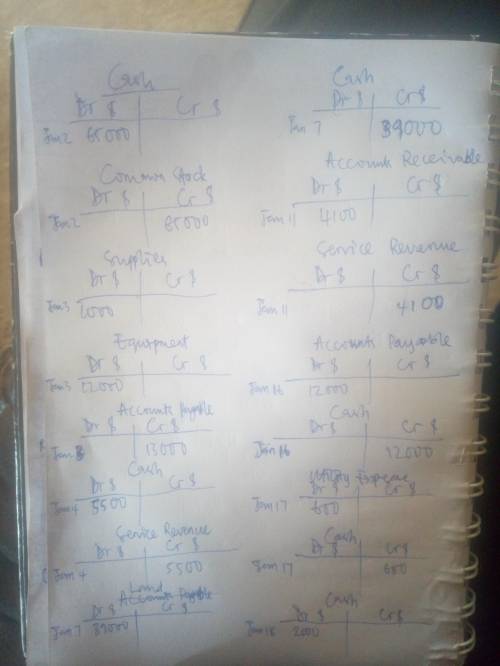

Jan 2 Wortham Services received $65,000 cash and issued common stock to the stockholders.

3 Purchased supplies, $1,000, and equipment, $12,000, on account.

4 Performed services for a customer and received cash, $5,500.

7 Paid cash to acquire land, $39,000.

11 Performed services for a customer and billed the customer, $4,100. Wortham expects to collect within one month

16 Paid for the equipment purchased January 3 on account.

17 Paid for newspaper advertising, $600.

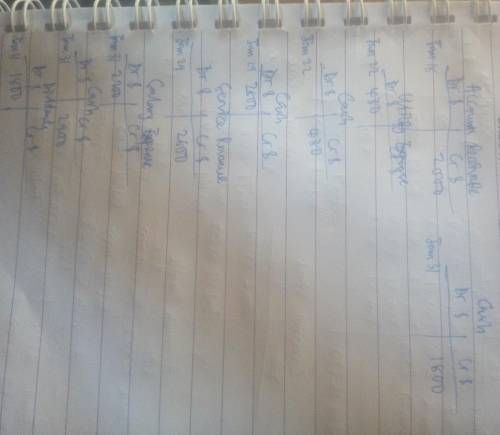

18 Received partial payment from customer on account, $2,000.

22 Paid the water and electricity bills, $430.

29 Received $2,600 cash for servicing the heating unit of a customer.

31 Paid employee salary, $2,900.

31 Declared and paid dividends of $1,800.

Requirements

1. Record each transaction in the journal. Key each transaction by date. Explanations are not required.

2. Post the transactions to the T-accounts, using transaction dates as posting references. Label the ending balance of each account Bal, as shown in the chapter.

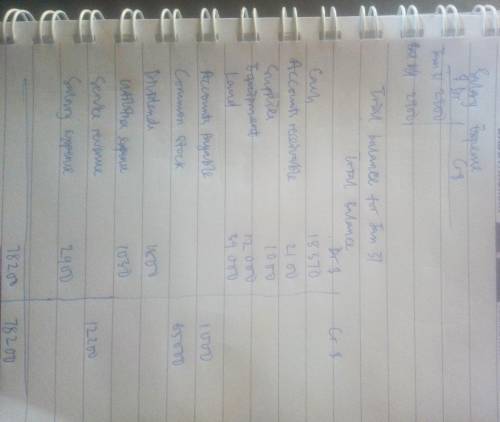

3. Prepare the trial balance of Wortham Services, Inc., at January 31 of the current year.

4. Mark Wortham, the manager, asks you how much in total resources the business has to work with, how much it owes, and whether January was proîtable (and by how much).

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 23:30, glissman8459

What is the difference between career options in the law enforcement pathway and career options in the correction services pathway?

Answers: 1

Business, 23.06.2019 02:30, PinkyUSA18

Complete electronics inc. sells a point-of-sale computer with a two-year service contract. complete collects $ 2 comma 500 cash for the selling price of the computer and $ 576 for the two-year service contract. how is revenue recognized?

Answers: 2

Do you know the correct answer?

During the first month of operations, Wortham Services, Inc., completed the following transactions:...

Questions in other subjects:

History, 31.03.2020 17:04

History, 31.03.2020 17:04

History, 31.03.2020 17:04

Mathematics, 31.03.2020 17:04