Business, 04.08.2020 21:01, angeladominguezgarci

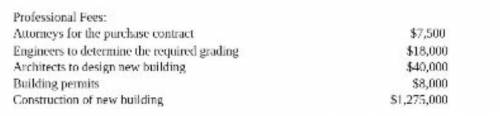

In 20X4, X Company purchased land for a new office building at a purchase price of $325,000. There was an existing building on the site that was demolished at a cost of $12,000. Scrap from the demolition was sold for $3,500. The building was completed during 20X4. In addition:

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 09:40, ameliaduxha7

You plan to invest some money in a bank account. which of the following banks provides you with the highest effective rate of interest? hint: perhaps this problem requires some calculations. bank 1; 6.1% with annual compounding. bank 2; 6.0% with monthly compounding. bank 3; 6.0% with annual compounding. bank 4; 6.0% with quarterly compounding. bank 5; 6.0% with daily (365-day) compounding.

Answers: 3

Business, 22.06.2019 16:30, allytrujillo20oy0dib

Summarize the specific methods used by interest groups in order to influence governmental decisions making in all three branches of government. provide at least two examples from each branch.

Answers: 3

Business, 22.06.2019 21:10, stephany94

You are the manager of a large crude-oil refinery. as part of the refining process, a certain heat exchanger (operated at high temperatures and with abrasive material flowing through it) must be replaced every year. the replacement and downtime cost in the first year is $165 comma 000. this cost is expected to increase due to inflation at a rate of 7% per year for six years (i. e. until the eoy 7), at which time this particular heat exchanger will no longer be needed. if the company's cost of capital is 15% per year, how much could you afford to spend for a higher quality heat exchanger so that these annual replacement and downtime costs could be eliminated?

Answers: 1

Business, 22.06.2019 22:00, levicorey846

On january 8, the end of the first weekly pay period of the year, regis company's payroll register showed that its employees earned $22,760 of office salaries and $70,840 of sales salaries. withholdings from the employees' salaries include fica social security taxes at the rate of 6.20%, fica medicare taxes at the rate of 1.45%, $13,260 of federal income taxes, $1,450 of medical insurance deductions, and $860 of union dues. no employee earned more than $7,000 in this first pay period. required: 1.1 calculate below the amounts for each of these four taxes of regis company. regis’s merit rating reduces its state unemployment tax rate to 3% of the first $7,000 paid to each employee. the federal unemployment tax rate is 0.60

Answers: 3

Do you know the correct answer?

In 20X4, X Company purchased land for a new office building at a purchase price of $325,000. There w...

Questions in other subjects:

Mathematics, 05.10.2020 16:01

Mathematics, 05.10.2020 16:01

Mathematics, 05.10.2020 16:01