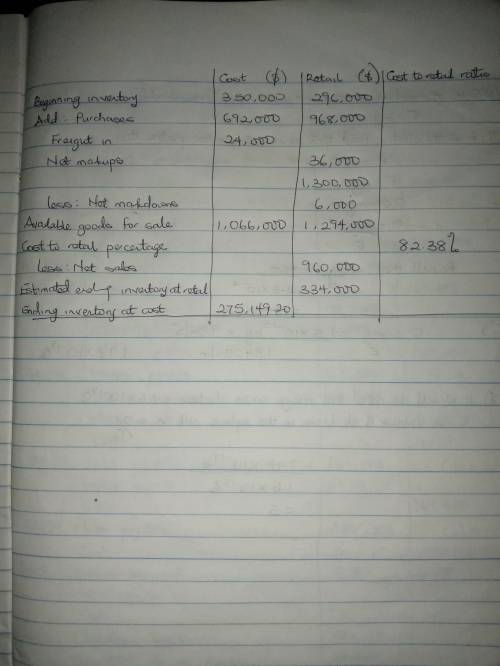

Campbell Corporation uses the retail method to value its inventory. The following information is available for the year 2021: Cost Retail Merchandise inventory, January 1, 2021 $ 350,000 $ 296,000 Purchases 692,000 968,000 Freight-in 24,000 Net markups 36,000 Net markdowns 6,000 Net sales 960,000 Required: Determine the December 31, 2021, inventory by applying the conventional retail method using the information provided.

Answers: 3

Other questions on the subject: Business

Business, 21.06.2019 23:30, reddmeans6

Starting at age 30, you deposit $2000 a year into an ira account for retirement. treat the yearly deposits into the account as a continuous income stream. if money in the account earns 7%, compounded continuously, how much will be in the account 35 years later, when you retire at age 65? how much of the final amount is interest?

Answers: 2

Business, 22.06.2019 13:30, karenjunior

Over the past year, three of the star salesmen at family resorts international's corporate office have been lured away to competitors. on top of that, karina, the general manager of the sales department, has noticed that most employees come in, do their jobs, and leave. family resorts offers a good salary, benefits, and tuition reimbursement, as well as a number of development and training programs. most employees seem contented enough, but karina would like to do something to increase the level of engagement among her staff. what do you think karina should do?

Answers: 1

Business, 22.06.2019 15:30, graciemccain

On january 15, the end of the first biweekly pay period of the year, north company’s payroll register showed that its employees earned $32,000 of sales salaries. withholdings from the employees’ salaries include fica social security taxes at the rate of 6.2%, fica medicare taxes at the rate of 1.45%, $3,000 of federal income taxes, $772 of medical insurance deductions, and $260 of union dues. no employee earned > $7,000 in this first period. prepare the journal entry to record north company’s january 15 (employee) payroll expenses and liabilities.

Answers: 3

Do you know the correct answer?

Campbell Corporation uses the retail method to value its inventory. The following information is ava...

Questions in other subjects:

Health, 24.10.2020 02:20

Computers and Technology, 24.10.2020 02:20

Mathematics, 24.10.2020 02:20

Mathematics, 24.10.2020 02:20

Mathematics, 24.10.2020 02:20

Mathematics, 24.10.2020 02:20