McEwan Industries sells on terms of 3/10, net 40, Total sales for the year are $838,000; 40% of the customers pay on the 10th day and take discounts, while the other 60% pay, on average, 84 days after their purchases. Assume 365 days in year for your calculations

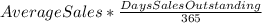

a. What is the days sales outstanding? Round your answer to two decimal places. days

b. What is the average amount of receivables? Do not round intermediate calculations. Round your answer to the nearest cent.

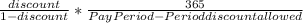

c. What is the percentage cost of trade credit to customers who take the discount? If your answer is zero, enter zero. Round your answer to two decimal places.

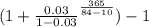

d. What is the percentage cost of trade credit to customers who do not take the discount and pay in 84 days? If your answer is zero, enter zero. Do not round intermediate calculations. Round your answers to two decimal places.

Nominal cost:

Effective cost:

e. What would happen to McEwan's accounts receivable if it toughened up on its collection policy with the result that all nondiscount customers paid on the 40th day?

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 05:10, russboys3

The total value of your portfolio is $10,000: $3,000 of it is invested in stock a and the remainder invested in stock b. stock a has a beta of 0.8; stock b has a beta of 1.2. the risk premium on the market portfolio is 8%; the risk-free rate is 2%. additional information on stocks a and b is provided below. return in each state state probability of state stock a stock b excellent 15% 15% 5% normal 50% 9% 7% poor 35% -15% 10% what are each stock’s expected return and the standard deviation? what are the expected return and the standard deviation of your portfolio? what is the beta of your portfolio? using capm, what is the expected return on the portfolio? given your answer above, would you buy, sell, or hold the portfolio?

Answers: 1

Business, 22.06.2019 09:00, nicoleaaliyah

Brian has been working for a few years now and has saved a substantial amount of money. he now wants to invest 50 percent of his savings in a bank account where it will be locked for three years and gain interest. which type of bank account should brian open? a. savings account b. money market account c. checking account d. certificate of deposit

Answers: 1

Business, 22.06.2019 10:00, chancegodwin5

In a small group, members have taken on the task roles of information giver, critic/analyzer, and recorder, and the maintenance roles of gatekeeper and follower. they need to fulfill one more role. which of the following would be most effective for their group dynamics? a dominator b coordinator c opinion seeker d harmonizer

Answers: 1

Do you know the correct answer?

McEwan Industries sells on terms of 3/10, net 40, Total sales for the year are $838,000; 40% of the...

Questions in other subjects:

Mathematics, 21.05.2021 21:50

Mathematics, 21.05.2021 21:50

Social Studies, 21.05.2021 21:50

Mathematics, 21.05.2021 21:50

Mathematics, 21.05.2021 21:50