A distributor of large appliances needs to determine the order quantities and reorder points for the various products it carries. The following data refer to a specific refrigerator in its product line.

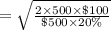

Cost to place an order $100 / order

Holding cost 20 percent of product cost per year

Cost of refrigerator $500 / unit

Annual demand 500 units

Standard deviation of

demand during lead time 10 units

Lead time 7 days

Consider an even daily demand and a 365-day year.

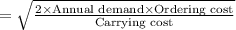

a. What is the economic order quantity?

b. If the distributor wants a 97 percent service probability, what reorder point, R, should be used?

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 21:30, Brandonjr12

In a macroeconomic context, what are implicit liabilities? money owed to people possessing government issued bonds. the amount of money that firms collectively owe to shareholders. money that the government has promised to pay in the future. payments that the federal government undertakes only during periods of recession. which of the choices is a significant implicit liability in the united states? military spending education spending national science foundation spending social security

Answers: 2

Business, 22.06.2019 02:10, dakodahepps

Materials purchases (on credit). direct materials used in production. direct labor paid and assigned to work in process inventory. indirect labor paid and assigned to factory overhead. overhead costs applied to work in process inventory. actual overhead costs incurred, including indirect materials. (factory rent and utilities are paid in cash.) transfer of jobs 306 and 307 to finished goods inventory. cost of goods sold for job 306. revenue from the sale of job 306. assignment of any underapplied or overapplied overhead to the cost of goods sold account. (the amount is not material.) 2. prepare journal entries for the month of april to record the above transactions.

Answers: 1

Business, 22.06.2019 16:20, Zshotgun33

Suppose you hold a portfolio consisting of a $10,000 investment in each of 8 different common stocks. the portfolio's beta is 1.25. now suppose you decided to sell one of your stocks that has a beta of 1.00 and to use the proceeds to buy a replacement stock with a beta of 1.55. what would the portfolio's new beta be? do not round your intermediate calculations.

Answers: 2

Do you know the correct answer?

A distributor of large appliances needs to determine the order quantities and reorder points for the...

Questions in other subjects:

Health, 25.07.2019 09:50

Social Studies, 25.07.2019 09:50

Biology, 25.07.2019 09:50

History, 25.07.2019 09:50

World Languages, 25.07.2019 09:50