Business, 01.07.2020 15:01, kaitlyn114433

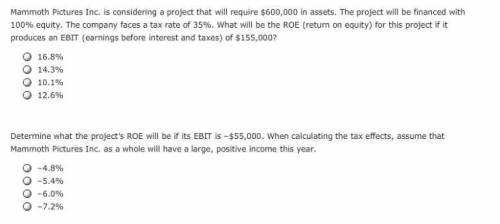

Determine what the project’s ROE will be if its EBIT is –$55,000. When calculating the tax effects, assume that Flowers by Irene Inc. as a whole will have a large, positive income this year.

a. -8.62%

b. -7.5%

c. -7.87%

d. -6.75%

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 05:30, 2023greenlanden

The hartman family is saving $400 monthly for ronald's college education. the family anticipates they will need to contribute $20,000 towards his first year of college, which is in 4 years .which best explain s whether the family will have enough money in 4 years ?

Answers: 1

Business, 22.06.2019 05:50, Haddixhouse8948

Match each of the terms below with an example that fits the term. a. fungibility the production of gasoline b. inelasticity the switch from coffee to tea c. non-excludability the provision of national defense d. substitution the demand for cigarettes

Answers: 2

Business, 22.06.2019 15:20, babyduck0664

Martinez company has the following two temporary differences between its income tax expense and income taxes payable. 2017 2018 2019 pretax financial income $873,000 $866,000 $947,000 (2017' 2018, 2019) excess depreciation expense on tax return (29,400 ) (39,000 ) (9,600 ) (2017' 2018, 2019) excess warranty expense in financial income 20,000 9,900 8,300 (2017' 2018, 2019) taxable income $863,600 $836,900 $945,700(2017' 2018, 2019) the income tax rate for all years is 40%. instructions: a. prepare the journal entry to record income tax expense, deferred income taxes, and income taxes payable for 2017, 2018, and 2019. b. assuming there were no temporary differences prior to 2016, indicate how deferred taxes will be reported on the 2016 balance sheet. button's warranty is for 12 months. c. prepare the income tax expense section of the income statement for 2017, beginning with the line, "pretax financial income."

Answers: 3

Business, 22.06.2019 23:30, autumnsusan190ox9kn4

Decision alternatives should be identified before decision criteria are established. are limited to quantitative solutions are evaluated as a part of the problem definition stage. are best generated by brain-storming.

Answers: 1

Do you know the correct answer?

Determine what the project’s ROE will be if its EBIT is –$55,000. When calculating the tax effects,...

Questions in other subjects:

English, 25.03.2021 14:20

Arts, 25.03.2021 14:20

Mathematics, 25.03.2021 14:20