Business, 26.06.2020 15:01, Gghbhgy4809

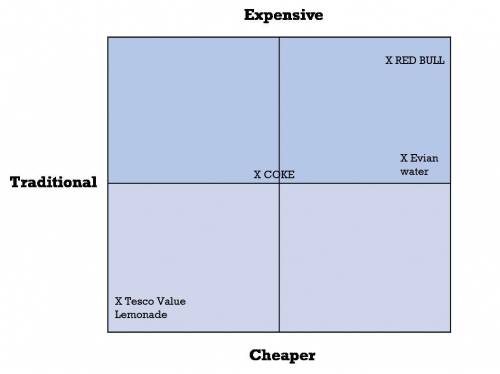

MINI CASE STUDY - 6 marks In years gone by the soft drinks market was dominated by fizz, with Coca-Cola as the leading brand. Within UK sales of over £1 billion a year, Coke is stil massive, but in 2015 and 2016 sale fell. In recent years the big winners have been: Main water brands, e. g. Evian Energy drinks e. g. Red Bull/Monster Adult-focused drinks, such as Fever-Tree Drinks with a healthy ‘vibe’ such as Innocent Coconut water. Oddly, though in the UK no one has quite managed the trick pulled off by Oasis in America; a big selling, non-fizzy drink for adults. Answer the below questions: Q1. Outline one possible reasons why UK sale of Coca-Cola are declining (2 marks) Q2. a) Outline where you think Coconut Water is positioned on the soft drinks market map. (2 marks) b) Outline one benefit of that positioning for a business such as Innocent drinks. (2 marks)

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 04:00, hahalol123goaway

Which law would encourage more people to become homeowners but not encourage risky loans that could end in foreclosure? options: offering first time homebuyers tax-free accounts to save for down payments requiring all mortgages to be more affordable, interest-only loans outlawing home inspections and appraisals by mortgage companies limiting rent increases to less than 2% a year

Answers: 2

Business, 22.06.2019 06:40, lexhorton2002

Burke enterprises is considering a machine costing $30 billion that will result in initial after-tax cash savings of $3.7 billion at the end of the first year, and these savings will grow at a rate of 2 percent per year for 11 years. after 11 years, the company can sell the parts for $5 billion. burke has a target debt/equity ratio of 1.2, a beta of 1.79. you estimate that the return on the market is 7.5% and t-bills are currently yielding 2.5%. burke has two issuances of bonds outstanding. the first has 200,000 bonds trading at 98% of par, with coupons of 5%, face of $1000, and maturity of 5 years. the second has 500,000 bonds trading at par, with coupons of 7.5%, face of $1000, and maturity of 12 years. kate, the ceo, usually applies an adjustment factor to the discount rate of +2 for such highly innovative projects. should the company take on the project?

Answers: 1

Business, 22.06.2019 12:30, chycooper101

Rossdale co. stock currently sells for $68.91 per share and has a beta of 0.88. the market risk premium is 7.10 percent and the risk-free rate is 2.91 percent annually. the company just paid a dividend of $3.57 per share, which it has pledged to increase at an annual rate of 3.25 percent indefinitely. what is your best estimate of the company's cost of equity?

Answers: 1

Business, 22.06.2019 12:30, dtrdtrdtrdtrdrt1325

Suppose a holiday inn hotel has annual fixed costs applicable to its rooms of $1.2 million for its 300-room hotel, average daily room rents of $50, and average variable costs of $10 for each room rented. it operates 365 days per year. the amount of operating income on rooms, assuming an occupancy* rate of 80% for the year, that will be generated for the entire year is *occupancy = % of rooms rented

Answers: 1

Do you know the correct answer?

MINI CASE STUDY - 6 marks In years gone by the soft drinks market was dominated by fizz, with Coca-C...

Questions in other subjects:

Mathematics, 05.03.2021 02:10

Mathematics, 05.03.2021 02:10

Mathematics, 05.03.2021 02:10

Social Studies, 05.03.2021 02:10

Mathematics, 05.03.2021 02:10

Mathematics, 05.03.2021 02:10