Business, 25.06.2020 07:01, olivia0420

You have just been offered your dream job after graduating from Jacksonville University. In response to your negotiations concerning your compensation package, the company has offered you a couple of different stock options in addition to the agreed upon salary.

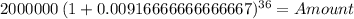

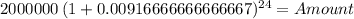

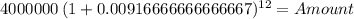

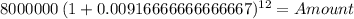

Under the first option, you would receive stocks with a value of $2,000,000 at the end of each year. This option also includes an additional $4,000,000 bonus that you would receive for staying at the company for 3 years.

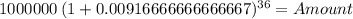

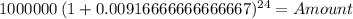

Under the second option, you would receive stocks with a value of $1,000,000 at the end of each year. This option also includes an additional $8,000,000 bonus that you would receive for staying at the company for 3 years.

Assume that these stocks grow at a rate of 11% compounded monthly. Moreover, assume that you will leave the company at the end of your fourth year to start your own firm. Which option will you choose. (The more money you have to start your own firm, the better.)

Your formal solutions should include ...

⦁ The overall goal and/or purpose.

⦁ The given information

⦁ A time-line for each option

⦁ A future value for each individual stock payment provided you by the company

⦁ The total future value of each option at the time you plan to leave the company

⦁ Your conclusion

Answers: 3

Other questions on the subject: Business

Business, 21.06.2019 23:30, BrezzyGirl9148

Afinancial institution, the thriftem bank, is in the process of formulating its loan policy for the next quarter. a total of $12 million is allocated for that purpose. being a full-service facility, the bank is obligated to grant loans to different clientele. the following table provides the types of loans, the interest rate charged by the bank, and the possibility of bad debt as estimated from past experience. type of loaninterest rateprobability of bad debtpersonal.140.10car.130.07home.1 20.03farm.125.05commercial.100.02 bad debts are assumed unrecoverable and hence produce no interest revenue either. competition with other financial institutions in the area requires that the bank allocate at least 40% of the total funds to farm and commercial loans. to assist the housing industry in the region, home loans must equal at least 50% of the personal, car, and home loans. the bank also has a stated policy specifying that the overall ratio for bad debts on all loans may not exceed .04. formulate this problem as a linear program. define your variables clearly and write all the constraints explaining the significance of each.

Answers: 1

Business, 22.06.2019 10:50, jadeafrias

You are evaluating two different silicon wafer milling machines. the techron i costs $285,000, has a three-year life, and has pretax operating costs of $78,000 per year. the techron ii costs $495,000, has a five-year life, and has pretax operating costs of $45,000 per year. for both milling machines, use straight-line depreciation to zero over the project’s life and assume a salvage value of $55,000. if your tax rate is 24 percent and your discount rate is 11 percent, compute the eac for both machines.

Answers: 3

Business, 22.06.2019 19:30, alejandra340

Adisadvantage of corporations is that shareholders have to pay on profits.

Answers: 1

Business, 22.06.2019 20:20, Hi123the

Garcia industries has sales of $200,000 and accounts receivable of $18,500, and it gives its customers 25 days to pay. the industry average dso is 27 days, based on a 365-day year. if the company changes its credit and collection policy sufficiently to cause its dso to fall to the industry average, and if it earns 8.0% on any cash freed-up by this change, how would that affect its net income, assuming other things are held constant? a. $241.45b. $254.16c. $267.54d. $281.62e. $296.44

Answers: 2

Do you know the correct answer?

You have just been offered your dream job after graduating from Jacksonville University. In response...

Questions in other subjects:

History, 06.09.2019 00:10

English, 06.09.2019 00:10

Mathematics, 06.09.2019 00:10

Mathematics, 06.09.2019 00:20

Mathematics, 06.09.2019 00:20

Mathematics, 06.09.2019 00:20

Biology, 06.09.2019 00:20