Business, 19.06.2020 20:57, ladnerhailey16

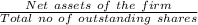

Baruk Industries has no cash and a debt obligation of $36 million that is now due. The market value of Baruk's assets is $ 81$81 million, and the firm has no other liabilities. Assume perfect capital markets. a. Suppose Baruk has 1010 million shares outstanding. What is Baruk's current share price? b. How many new shares must Baruk issue to raise the capital needed to pay its debt obligation? c. After repaying the debt, what will Baruk's share price be?

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 01:30, rhettperkins

Emil motycka is considered an entrepreneur because

Answers: 2

Business, 22.06.2019 16:00, knownperson233

In macroeconomics, to study the aggregate means to study blank

Answers: 1

Business, 22.06.2019 17:30, lanamiami

After the embarrassing sign incident at the restaurant you own, you decide to offer employees a six-week fundamental writing skills workshop. a local business communication instructor, who has experience teaching writing skills at treleaven community college, will facilitate the sessions. to encourage employees to attend these optional sessions, write an email that explains why you’re offering the workshop and why employees should participate.

Answers: 2

Business, 23.06.2019 07:00, TheMixingToad

Will mark you the which of the following groups has caused ongoing conflicts in afghanistan? a. the sinhalese majority b. natalitesc. kashmir sikhsd. the taliban

Answers: 2

Do you know the correct answer?

Baruk Industries has no cash and a debt obligation of $36 million that is now due. The market value...

Questions in other subjects:

Mathematics, 18.12.2020 05:20

History, 18.12.2020 05:20

History, 18.12.2020 05:20

Geography, 18.12.2020 05:20

Mathematics, 18.12.2020 05:20

Mathematics, 18.12.2020 05:20

English, 18.12.2020 05:20

History, 18.12.2020 05:20

= $

= $

= $

= $