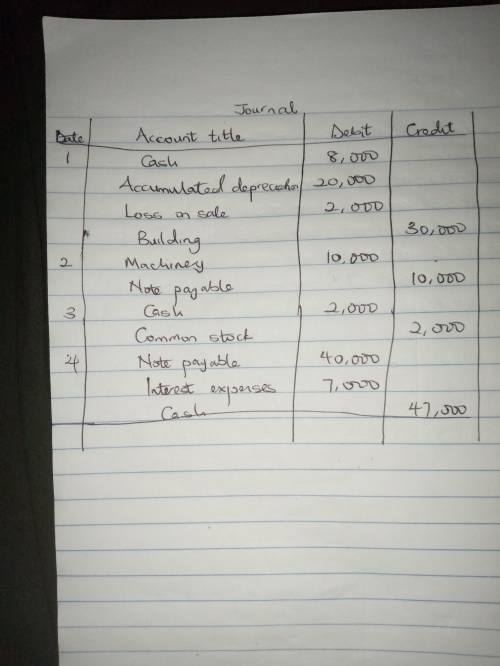

For each of the following separate transactions,

(a) prepare the reconstructed journal entry and

(b) identify the effect it has, if any, on the investing section or financing section of the statement of cash flows.

1. Sold a building costing $30,000, with $20,000 of accumulated depreciation, for $8,000 cash, resulting in a $2,000 loss.

2. Acquired machinery worth $10,000 by issuing $10,000 in notes payable.

3. Issued 1,000 shares of common stock at par for $2 per share.

4. Notes payable with a carrying value of $40,000 were retired for $47,000 cash, resulting in a $7,000 loss

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 07:00, robertotugalanp1wlgs

Bridgeport company began operations at the beginning of 2018. the following information pertains to this company. 1. pretax financial income for 2018 is $115,000. 2. the tax rate enacted for 2018 and future years is 40%. 3. differences between the 2018 income statement and tax return are listed below: (a) warranty expense accrued for financial reporting purposes amounts to $7,500. warranty deductions per the tax return amount to $2,200. (b) gross profit on construction contracts using the percentage-of-completion method per books amounts to $94,700. gross profit on construction contracts for tax purposes amounts to $67,100. (c) depreciation of property, plant, and equipment for financial reporting purposes amounts to $61,800. depreciation of these assets amounts to $75,700 for the tax return. (d) a $3,600 fine paid for violation of pollution laws was deducted in computing pretax financial income. (e) interest revenue recognized on an investment in tax-exempt municipal bonds amounts to $1,500. 4. taxable income is expected for the next few years. (assume (a) is short-term in nature; assume (b) and (c) are long-term in nature.) (a) prepare the reconciliation schedule for 2017 and future years. (b) prepare the journal entry to record income tax expense for 2017. (c) prepare the income tax expense section of the income statement beginning with “income before income taxes.” (d) determine how the deferred taxes will appear on the balance sheet at the end of 2017.

Answers: 1

Business, 22.06.2019 08:30, labrandonanderson00

What is the equity method balance in the investment in lindman account at the end of 2018?

Answers: 2

Business, 22.06.2019 18:00, firesoccer53881

If you would like to ask a question you will have to spend some points

Answers: 1

Business, 22.06.2019 19:00, nativebabydoll35

In north korea, a farmer’s income is the same as a dentist’s income. in a country with a mixed or market economy, the difference between those two professions might be more than 5 times different. how can you explain the fact that individuals doing the same work in different countries do not earn comparable salaries?

Answers: 1

Do you know the correct answer?

For each of the following separate transactions,

(a) prepare the reconstructed journal entry and

Questions in other subjects:

Mathematics, 03.12.2020 21:20

Mathematics, 03.12.2020 21:20

Mathematics, 03.12.2020 21:20

Mathematics, 03.12.2020 21:20

Mathematics, 03.12.2020 21:20

Mathematics, 03.12.2020 21:20