Long-Term Notes Receivable and TVM. Use the following present value tables to help answer the following questions. *Do not round any answer until your final answer. Round your final answer to the nearest whole dollar. When entering your final answer, do not use commas or $ sign. (Sorry...Blackboard is very sensitive and will mark your answer incorrect due to rounding and punctuation.)

PV of $1

Periods 4% 6% 8% 9%

3 .89 .84 .79 .77

5 .82 .74 .68 .65

9 .70 .59 .50 .46

10 .68 .56 .46 .42

Present Value of an Ordinary Annuity

Period 4% 6% 8% 9%

3 2.77 2.67 2.57 2.53

5 4.45 4.21 3.99 3.89

9 7.43 6.80 6.25 5.99

10 8.11 7.36 6.71 6.41

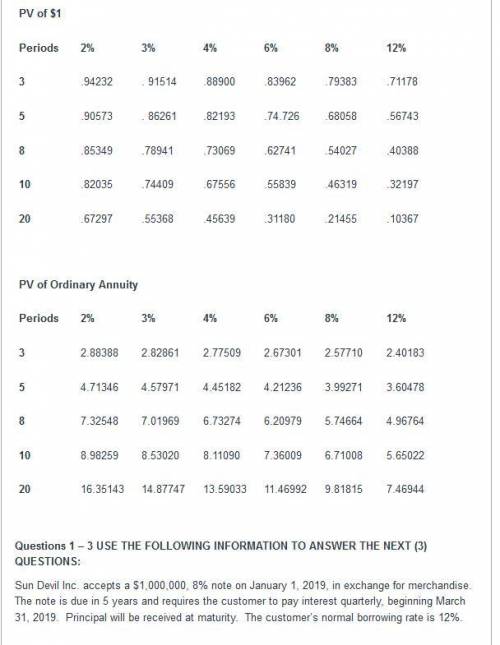

USE THE FOLLOWING INFORMATION TO ANSWER THE NEXT (3) QUESTIONS:Sun Devil Inc. accepts a $1,000,000, 8% note on January 1, 2019, in exchange for merchandise. The note is due in 5 years and requires the customer to pay interest quarterly, beginning March 31, 2019. Principal will be received at maturity. The customer’s normal borrowing rate is 12%. Determine the amount of Sales Revenue Sun Devil can recognize on Jan 1, 2019: $Using the information in #1 above, determine the carrying value of the Note Receivable at December 31, 2021: $Using the information in #1 above, determine the Total Interest Revenue Sun Devil will earn over the entire 5-year lending agreement:$

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 02:20, gabegabemm1

The following information is available for jase company: market price per share of common stock $25.00 earnings per share on common stock $1.25 which of the following statements is correct? a. the price-earnings ratio is 20 and a share of common stock was selling for 20 times the amount of earnings per share at the end of the year. b. the market price per share and the earnings per share are not statistically related to each other. c. the price-earnings ratio is 5% and a share of common stock was selling for 5% more than the amount of earnings per share at the end of the year. d. the price-earnings ratio is 10 and a share of common stock was selling for 125 times the amount of earnings per share at the end of the year.

Answers: 1

Business, 22.06.2019 08:10, alex7881

The last time he flew jet value air, juan's plane developed a fuel leak and had to make an 4) emergency landing. the time before that, his plane was grounded because of an electrical problem. juan is sure his current trip will be fraught with problems and he will once again be delayed. this is an example of the bias a) confirmation b) availability c) selective perception d) randomness

Answers: 1

Business, 22.06.2019 17:00, martinez6221

Vincent is interested in increasing his earning potential upon completing his internship at a major accounting firm. which option can immediately boost his career in the intended direction? b. complete a certification from a professional organization c. complete a new four-year undergraduate program in a related field d. complete a two-year associate degree in a related field e. complete an online course in accounting

Answers: 3

Business, 22.06.2019 20:00, Hockeypro1127

An arithmetic progression involves the addition of the same quantity to each number. which might represent the arithmetic growth of agricultural production

Answers: 3

Do you know the correct answer?

Long-Term Notes Receivable and TVM. Use the following present value tables to help answer the follo...

Questions in other subjects:

Chemistry, 21.07.2020 17:01