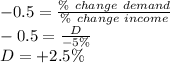

Suppose the income elasticity of demand is -0.5 for good X. This implies that a 5% decrease in income will cause the quantity demanded of good X to a. increase by 2.5%, and X is an inferior good. b. decrease by 2.5% and X is a normal good. c. increase by 10% and X is an inferior good. d. decrease by 10% and X is a normal good.

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 07:30, taridunkley724

Hours to produce one unit worker hours to produce yarn country a 8 hours country b 4 hours worker hours to produce fabric counrty a 12 hours country b 13 hours additional worker hours to produce fabric instead of yarn country a ? country b? which of the follow is true of the trade relationship between country a and country b? country a has an absolute advantage in producing yarn and fabric country b has an absolute advantage in producing yarn and fabric country b has a comparative advantage to country a in producing fabric country a has a comparative advantage to country b in producing fabric

Answers: 2

Business, 22.06.2019 09:00, nadiarose6345

Consider the scenario below and let us know if you believe lauren smith's actions to be ethical. let us know why or why not. lauren smith is the controller for sports central, a chain of sporting goods stores. she has been asked to recommend a site for a new store. lauren has an uncle who owns a shopping plaza in the area of town where the new store is to be located, so she decides to contact her uncle about leasing space in his plaza. lauren also contacted several other shopping plazas and malls, but her uncle’s store turned out to be the most economical place to lease. therefore, lauren recommended locating the new store in her uncle’s shopping plaza. in making her recommendation to management, she did not disclose that her uncle owns the shopping plaza. if management decided to go with lauren's uncle's plaza, what additional information would be needed in the financial statements?

Answers: 2

Business, 22.06.2019 15:40, aroman4511

Rachel died in 2014 and her executor is finalizing her estate tax return. the executor has determined that rachel’s adjusted gross estate is $10,120,000 and that her estate is entitled to a charitable deduction in the amount of $500,000. using 2014 rates, calculate the estate tax liability for rachel’s estate.

Answers: 1

Business, 22.06.2019 19:30, Lucid4465

Which of the following constitute the types of unemployment occurring at the natural rate of unemployment? a. frictional and cyclical unemployment. b. structural and frictional unemployment. c. cyclical and structural unemployment. d. frictional, structural, and cyclical unemployment.

Answers: 2

Do you know the correct answer?

Suppose the income elasticity of demand is -0.5 for good X. This implies that a 5% decrease in incom...

Questions in other subjects:

Health, 06.10.2020 14:01

Mathematics, 06.10.2020 14:01

Mathematics, 06.10.2020 14:01

Mathematics, 06.10.2020 14:01

Mathematics, 06.10.2020 14:01