Business, 07.06.2020 04:57, miguelpoblano5673

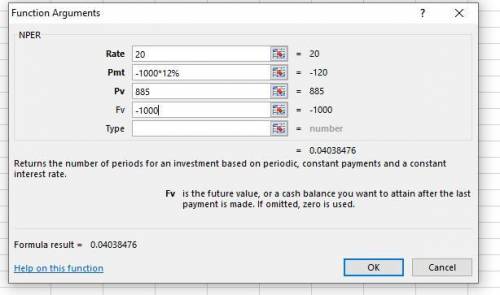

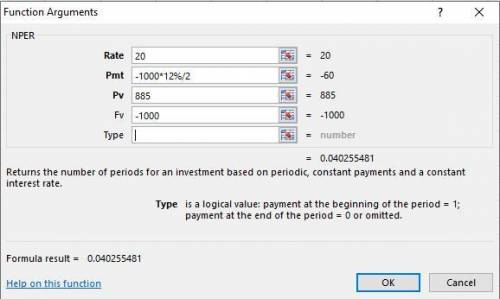

A 20-year bond of a firm in severe financial distress has a coupon rate of 12% and sells for $885. The firm is currently renegotiating the debt, and it appears that the lenders will allow the firm to reduce coupon payments on the bond to one-half the originally contracted amount. The firm can handle these lower payments. What is (a) the stated and (b) the expected yield to maturity of the bonds? The bond makes its coupon payments annually. (Do not round intermediate calculations. Round your answers to 3 decimal places.)

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 07:30, natebarr17

Select the correct answer. sarah works in a coffee house where she is responsible for keying in customer orders. a customer orders snacks and coffee, but later, cancels th snacks, saying she wants only coffee. at the end of the day, sarah finds that there is a mismatch in the snack items ordered. which term suggest data has been violated? a. security b. integrity c. adding d. reliability e. reporting

Answers: 3

Business, 22.06.2019 08:00, truthqmatic16

Compare the sources of consumer credit(there's not just one answer)1. consumers use a prearranged loan using special checks2. consumers use cards with no interest and non -revolving balances3. consumers pay off debt and credit is automatically renewed4. consumers take out a loan with a repayment date and have a specific purposea. travel and entertainment creditb. revolving check creditc. closed-end creditd. revolving credit

Answers: 2

Business, 22.06.2019 11:10, takaralocklear

An insurance company estimates the probability of an earthquake in the next year to be 0.0015. the average damage done to a house by an earthquake it estimates to be $90,000. if the company offers earthquake insurance for $150, what is company`s expected value of the policy? hint: think, is it profitable for the insurance company or not? will they gain (positive expected value) or lose (negative expected value)? if the expected value is negative, remember to show "-" sign. no "+" sign needed for the positive expected value

Answers: 2

Business, 22.06.2019 16:00, ari313

What impact might an economic downturn have on a borrower’s fixed-rate mortgage? a. it might cause a borrower’s payments to go up. b. it might cause a borrower’s payments to go down. c. it has no impact because a fixed-rate mortgage cannot change. d. it has no impact because the economy does not affect interest rates.

Answers: 1

Do you know the correct answer?

A 20-year bond of a firm in severe financial distress has a coupon rate of 12% and sells for $885. T...

Questions in other subjects:

Biology, 06.11.2020 05:00

Mathematics, 06.11.2020 05:00

Mathematics, 06.11.2020 05:00

Mathematics, 06.11.2020 05:00

Mathematics, 06.11.2020 05:00