Business, 07.06.2020 03:58, alemvp7258

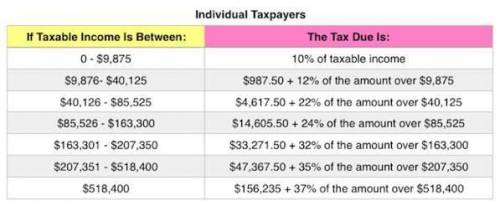

Chuck, a single taxpayer, earns $69,000 in taxable income and $27,100 in interest from an investment in City of Heflin bonds. (Use the U. S tax rate schedule.) Required: How much federal tax will he owe

Answers: 3

Other questions on the subject: Business

Business, 21.06.2019 22:20, trea56

Steele bicycle manufacturing company currently produces the handlebars used in manufacturing its bicycles, which are high-quality racing bikes with limited sales. steele produces and sells only 10,000 bikes each year. due to the low volume of activity, steele is unable to obtain the economies of scale that larger producers achieve. for example, steele could buy the handlebars for $31 each: they cost $34 each to make. the following is a detailed breakdown of current production costs: after seeing these figures, steele's president remarked that it would be foolish for the company to continue to produce the handlebars at $34 each when it can buy them for $31 each. calculate the total relevant cost. do you agree with the president's conclusion?

Answers: 1

Business, 22.06.2019 19:30, ssiy

Quick calculate the roi dollar amount and percentage for these example investments. a. you invest $50 in a government bond that says you can redeem it a year later for $55. use the instructions in lesson 3 to calculate the roi dollar amount and percentage. (3.0 points) tip: subtract the initial investment from the total return to get the roi dollar amount. then divide the roi dollar amount by the initial investment, and multiply that number by 100 to get the percentage. b. you invest $200 in stocks and sell them one year later for $230. use the instructions in lesson 3 to calculate the roi dollar amount and percentage. (3.0 points) tip: subtract the initial investment from the total return to get the roi dollar amount. then divide the roi dollar amount by the initial investment, and multiply that number by 100 to get the percentage.

Answers: 2

Business, 22.06.2019 21:00, nasrah

Dozier company produced and sold 1,000 units during its first month of operations. it reported the following costs and expenses for the month: direct materials $ 69,000 direct labor $ 35,000 variable manufacturing overhead $ 15,000 fixed manufacturing overhead 28,000 total manufacturing overhead $ 43,000 variable selling expense $ 12,000 fixed selling expense 18,000 total selling expense $ 30,000 variable administrative expense $ 4,000 fixed administrative expense 25,000 total administrative expense $ 29,000 required: 1. with respect to cost classifications for preparing financial statements: a. what is the total product cost

Answers: 2

Business, 22.06.2019 22:00, taliyahjhonson1

What legislation increased the ability for federal authorities to tap telephones and wireless devices, tightened the enforcement of money laundering activities, as well as broadened powers toward acts of terrorism and acts such as drug trafficking?

Answers: 2

Do you know the correct answer?

Chuck, a single taxpayer, earns $69,000 in taxable income and $27,100 in interest from an investment...

Questions in other subjects:

Mathematics, 28.04.2021 05:20

Mathematics, 28.04.2021 05:20

Health, 28.04.2021 05:20

Mathematics, 28.04.2021 05:20

Mathematics, 28.04.2021 05:20

Biology, 28.04.2021 05:20