Business, 02.06.2020 11:58, irenemonte

Delsing Canning Company is considering an expansion of its facilities. Its current income statement is as follows:

Sales $ 6,200,000

Variable costs (50% of sales) 3,100,000

Fixed costs 1,920,000

Earnings before interest and taxes (EBIT) $ 1,180,000

Interest (10% cost) 440,000

Earnings before taxes (EBT) $ 740,000

Tax (30%) 222,000

Earnings after taxes (EAT) $ 518,000

Shares of common stock 320,000

Earnings per share $ 1.62

The company is currently financed with 50 percent debt and 50 percent equity (common stock, par value of $10). In order to expand the facilities, Mr. Delsing estimates a need for $3.2 million in additional financing. His investment banker has laid out three plans for him to consider:

Sell $3.2 million of debt at 14 percent.

Sell $3.2 million of common stock at $20 per share.

Sell $1.60 million of debt at 13 percent and $1.60 million of common stock at $25 per share.

Variable costs are expected to stay at 50 percent of sales, while fixed expenses will increase to $2,420,000 per year. Delsing is not sure how much this expansion will add to sales, but he estimates that sales will rise by $1.60 million per year for the next five years.

Delsing is interested in a thorough analysis of his expansion plans and methods of financing. He would like you to analyze the following:

Required:

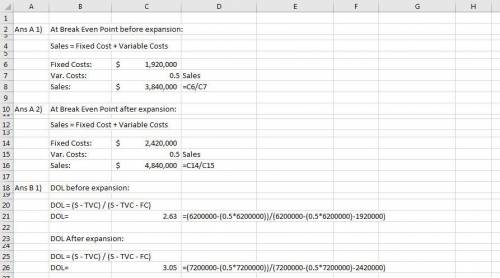

a. The break-even point for operating expenses before and after expansion (in sales dollars). (Enter your answers in dollars not in millions, i. e, $1,234,567.)

b. The degree of operating leverage before and after expansion. Assume sales of $6.2 million before expansion and $7.2 million after expansion. Use the formula: DOL = (S − TVC) / (S − TVC − FC). (Round your answers to 2 decimal places.)

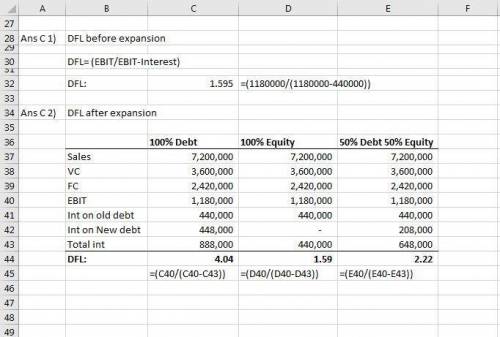

c-1. The degree of financial leverage before expansion. (Round your answers to 2 decimal places.)

c-2. The degree of financial leverage for all three methods after expansion. Assume sales of $7.2 million for this question. (Round your answers to 2 decimal places.)

d. Compute EPS under all three methods of financing the expansion at $7.2 million in sales (first year) and $10.1 million in sales (last year). (Round your answers to 2 decimal places.)

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 11:20, angeline2004

Stock a has a beta of 1.2 and a standard deviation of 20%. stock b has a beta of 0.8 and a standard deviation of 25%. portfolio p has $200,000 consisting of $100,000 invested in stock a and $100,000 in stock b. which of the following statements is correct? (assume that the stocks are in equilibrium.) (a) stock b has a higher required rate of return than stock a. (b) portfolio p has a standard deviation of 22.5%. (c) portfolio p has a beta equal to 1.0. (d) more information is needed to determine the portfolio's beta. (e) stock a's returns are less highly correlated with the returns on most other stocks than are b's returns.

Answers: 3

Business, 22.06.2019 20:50, aberiele1998

You are bearish on telecom and decide to sell short 100 shares at the current market price of $50 per share. a. how much in cash or securities must you put into your brokerage account if the broker’s initial margin requirement is 50% of the value of the short position? b. how high can the price of the stock go before you get a margin call if the maintenance margin is 30% of the value of the short position? (input the amount as a positive value. round your answer to 2 decimal places.)

Answers: 3

Business, 22.06.2019 21:50, noodleboy0923

Search engines generate revenue through pay-per-click (each time a user clicks a link to a retailer’s website); pay-per-call (each time a user clicks a link that takes the user to an online agent waiting for a call); or pay-per-conversion (each time a website visitor is converted to a customer)

Answers: 3

Do you know the correct answer?

Delsing Canning Company is considering an expansion of its facilities. Its current income statement...

Questions in other subjects:

Mathematics, 25.05.2021 20:10

Mathematics, 25.05.2021 20:10

Mathematics, 25.05.2021 20:10