Business, 31.05.2020 03:00, Calliedevore

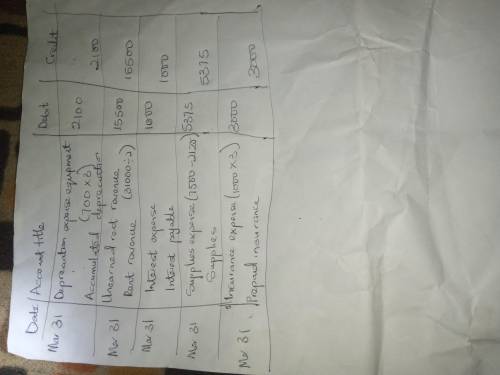

The ledger of Blue Spruce Corp. on March 31 of the current year includes the selected accounts below before adjusting entries have been prepared. Debit Credit Supplies $7,500 Prepaid Insurance 9,000 Equipment 62,500 Accumulated Depreciation—Equipment $21,000 Notes Payable 50,000 Unearned Rent Revenue 31,000 Rent Revenue 150,000 Interest Expense 0 Salaries and Wages Expense 35,000 An analysis of the accounts shows the following. 1. The equipment depreciates $700 per month. 2. Half of the unearned rent revenue was earned during the quarter. 3. Interest of $1,000 is accrued on the notes payable. 4. Supplies on hand total $2,125. 5. Insurance expires at the rate of $1,000 per month. Prepare the adjusting entries at March 31, assuming that adjusting entries are made quarterly. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually.)

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 10:30, volleyballfun24

Trecek corporation incurs research and development costs of $625,000 in 2017, 30 percent of which relate to development activities subsequent to ias 38 criteria having been met that indicate an intangible asset has been created. the newly developed product is brought to market in january 2018 and is expected to generate sales revenue for 10 years. assume that a u. s.–based company is issuing securities to foreign investors who require financial statements prepared in accordance with ifrs. thus, adjustments to convert from u. s. gaap to ifrs must be made. ignore income taxes. required: (a) prepare journal entries for research and development costs for the years ending december 31, 2017, and december 31, 2018, under (1) u. s. gaap and (2) ifrs. (c) prepare the entry(ies) that trecek would make on the december 31, 2017, and december 31, 2018, conversion worksheets to convert u. s. gaap balances to ifrs.

Answers: 1

Business, 22.06.2019 17:30, lanamiami

After the embarrassing sign incident at the restaurant you own, you decide to offer employees a six-week fundamental writing skills workshop. a local business communication instructor, who has experience teaching writing skills at treleaven community college, will facilitate the sessions. to encourage employees to attend these optional sessions, write an email that explains why you’re offering the workshop and why employees should participate.

Answers: 2

Business, 22.06.2019 19:30, dominickstrickland

Kirnon clinic uses client-visits as its measure of activity. during july, the clinic budgeted for 3,250 client-visits, but its actual level of activity was 3,160 client-visits. the clinic has provided the following data concerning the formulas to be used in its budgeting: fixed element per month variable element per client-visitrevenue - $ 39.10personnel expenses $ 35,100 $ 10.30medical supplies 1,100 7.10occupancy expenses 8,100 1.10administrative expenses 5,100 0.20total expenses $ 49,400 $ 18.70the activity variance for net operating income in july would be closest to:

Answers: 1

Business, 22.06.2019 20:30, boog89

Mordica company identifies three activities in its manufacturing process: machine setups, machining, and inspections. estimated annual overhead cost for each activity is $156,960, $382,800, and $84,640, respectively. the cost driver for each activity and the expected annual usage are number of setups 2,180, machine hours 25,520, and number of inspections 1,840. compute the overhead rate for each activity. machine setups $ per setup machining $ per machine hour inspections $ per inspection

Answers: 1

Do you know the correct answer?

The ledger of Blue Spruce Corp. on March 31 of the current year includes the selected accounts below...

Questions in other subjects:

Biology, 02.01.2020 07:31

Biology, 02.01.2020 07:31

History, 02.01.2020 07:31

Biology, 02.01.2020 07:31

Health, 02.01.2020 07:31

Health, 02.01.2020 07:31