Business, 24.05.2020 02:00, wedderman8292

Synthetic Fuels Corporation prepares its financial statements according to IFRS. On June 30, 2019, the company purchased equipment for $540,000. The equipment is expected to have a five-year useful life with no residual value. Synthetic uses the straight-line depreciation method for all depreciable assets and chooses to revalue the equipment. Fair value of the equipment was $524,880 at 12/31/2019 and $354,348 at 12/31/2020, respectively.

Required:

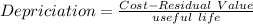

1. Calculate the depreciation for 2019 and prepare the journal entry to record it.

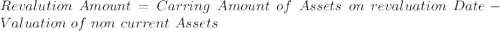

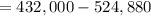

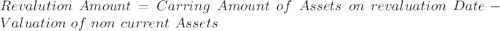

2. Prepare the journal entry to record the revaluation of the equipment at 12/31/2019 (Show supporting calculations).

3. Calculate the depreciation for 2020 and prepare the journal entry to record it.

4. Prepare the journal entry to record the revaluation of the equipment at 12/31/2020 (Show supporting calculations).

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 03:00, marahsenno

How could brian, who doesn't want his car insurance premiums to increase, show he poses a low risk to his insurance company? a: drive safely to avoid accidents and traffic citations b: wash and wax his car regularly to keep it clean c: allow unlicensed drivers to drive carelessly in his car d: incur driver's license points from breaking driving laws

Answers: 1

Business, 22.06.2019 22:30, dontcareanyonemo

Schuepfer inc. bases its selling and administrative expense budget on budgeted unit sales. the sales budget shows 1,800 units are planned to be sold in march. the variable selling and administrative expense is $4.30 per unit. the budgeted fixed selling and administrative expense is $35,620 per month, which includes depreciation of $2,700 per month. the remainder of the fixed selling and administrative expense represents current cash flows. the cash disbursements for selling and administrative expenses on the march selling and administrative expense budget should be:

Answers: 1

Business, 23.06.2019 02:00, kittybatch345

What percentage of hard rock's profit is derived from retail shop sales?

Answers: 1

Business, 23.06.2019 16:30, murtaghliam1

Circuittown commenced a gift card program in january 2018 and sold $12,150 of gift cards in january, $19,150 in february, and $18,100 in march of 2018 before discontinuing further gift card sales. during 2018, gift card redemptions were $7,850 for the january gift cards sold, $4,350 for the february cards, and $4,250 for the march cards. circuittown considers gift cards to be “broken” (not redeemable) 10 months after sale. required: 1. how much revenue will circuittown recognize with respect to january gift card sales during 2018? 2. prepare journal entries to record the sale of january gift cards, redemption of gift cards (ignore sales tax), and breakage (expiration) of gift cards. 3. how much revenue will circuittown recognize with respect to march gift card sales during 2018? 4. what liability for deferred revenue associated with gift card sales would circuittown show as of december 31, 2018?

Answers: 2

Do you know the correct answer?

Synthetic Fuels Corporation prepares its financial statements according to IFRS. On June 30, 2019, t...

Questions in other subjects:

Mathematics, 23.03.2020 21:41

Mathematics, 23.03.2020 21:41

Mathematics, 23.03.2020 21:41

Mathematics, 23.03.2020 21:41

(Gained revaluation)

(Gained revaluation)

(Loss revaluation)

(Loss revaluation)