Business, 21.05.2020 01:07, alishajade

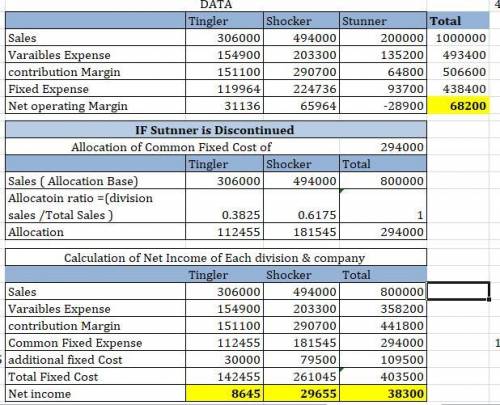

Cullumber Company makes three models of tasers. Information on the three products is given below. Tingler Shocker Stunner Sales $306,000 $494,000 $200,000 Variable expenses 154,900 203,300 135,200 Contribution margin 151,100 290,700 64,800 Fixed expenses 119,964 224,736 93,700 Net income $31,136 $65,964 $(28,900) Fixed expenses consist of $294,000 of common costs allocated to the three products based on relative sales, as well as direct fixed expenses unique to each model of $30,000 (Tingler), $79,500 (Shocker), and $34,900 (Stunner). The common costs will be incurred regardless of how many models are produced. The direct fixed expenses would be eliminated if that model is phased out. James Watt, an executive with the company, feels the Stunner line should be discontinued to increase the company’s net income. (a) Compute current net income for Cullumber Company. Net income $ (b) Compute net income by product line and in total for Cullumber Company if the company discontinues the Stunner product line. (Hint: Allocate the $294,000 common costs to the two remaining product lines based on their relative sales.) Tingler Net Income $ Shocker Net Income $ Total Net Income $ (c) Should Cullumber eliminate the Stunner product line? Why or why not? Net income would from $ to $ .

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 04:50, smeeden

Allie and sarah decided that they want to purchase renters insurance for the apartment they share. they made a list of all of the items to be covered by the insurance policy, along with their estimated values. if the items to be covered total more than $3000, the insurance company charges an annual premium of 23% of the total value of the items. if the items to be covered total $3000 or less, the insurance company charges an annual premium of 20% of the total value of the items.

Answers: 1

Business, 22.06.2019 11:10, nataliahenderso

Which feature is a characteristic of a corporation?

Answers: 1

Business, 22.06.2019 14:00, breana758

Bayside coatings company purchased waterproofing equipment on january 2, 20y4, for $190,000. the equipment was expected to have a useful life of four years and a residual value of $9,000. instructions: determine the amount of depreciation expense for the years ended december 31, 20y4, 20y5, 20y6, and 20y7, by (a) the straight-line method and (b) the double-declining-balance method. also determine the total depreciation expense for the four years by each method. depreciation expense year straight-line method double-declining-balance method 20y4 $ $ 20y5 20y6 20y7 total $

Answers: 3

Business, 22.06.2019 18:30, lebronbangs8930

> > objectives define federalism and explain why the framers adopted a federal system instead of a unitary system. categorize powers delegated to and denied to the national government, and powers reserved for and denied to the states, and the difference between exclusive and concurrent powers.

Answers: 1

Do you know the correct answer?

Cullumber Company makes three models of tasers. Information on the three products is given below. Ti...

Questions in other subjects:

Spanish, 24.07.2019 17:40

Physics, 24.07.2019 17:40

Biology, 24.07.2019 17:40

Biology, 24.07.2019 17:40