Business, 06.05.2020 05:45, tiwaribianca475

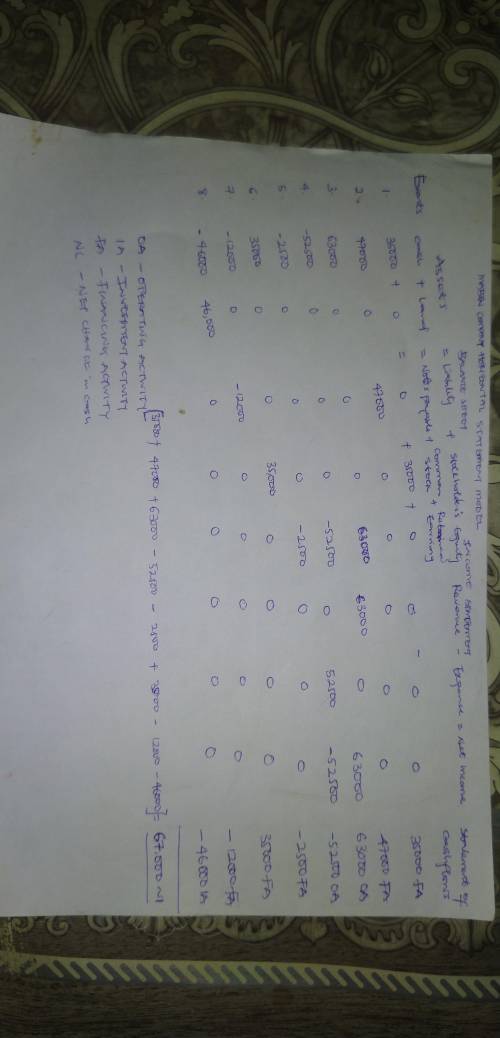

Maben Company was started on January 1, Year 1, and experienced the following events during its first year of operation:

1. Acquired $35,000 cash from the issue of common stock.

2. Borrowed $47,000 cash from National Bank.

3. Earned cash revenues of $63,000 for performing services.

4. Paid cash expenses of $52,500.

5. Paid a $2,500 cash dividend to the stockholders.

6. Acquired an additional $35,000 cash from the issue of common stock.

7. Paid $12,000 cash to reduce the principal balance of the banknote.

8. Paid $46,000 cash to purchase land.

9. Determined that the market value of the land is $64,000.

Required:

Show the effects of the events on the financial statements using a horizontal financial statements model. In the Cash Flow column, use OA to designate operating activity, IA for investment activity, FA for financing activity, and NC for net change in cash. (Enter any decreases to account balances with a minus sign. Not all cells in the "Statement of Cash Flows" column may require an input - leave cells blank if there is no corresponding input needed.)

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 08:50, cmflores3245

Suppose that in an economy the structural unemployment rate is 2.2 percent, the natural unemployment rate is 5.3 percent, and the cyclical unemployment rate is 2 percent. the frictional unemployment rate is percent and the actual unemployment rate (in this economy) is percent.

Answers: 2

Business, 22.06.2019 11:20, johnlecona210

Security a has a higher standard deviation of returns than security b. we would expect that: (i) security a would have a risk premium equal to security b. (ii) the likely range of returns for security a in any given year would be higher than the likely range of returns for security b. (iii) the sharpe ratio of a will be higher than the sharpe ratio of b. (a) i only (b) i and ii only (c) ii and iii only (d) i, ii and iii

Answers: 1

Business, 22.06.2019 19:40, pchisholm100

You estimate that your cattle farm will generate $0.15 million of profits on sales of $3 million under normal economic conditions and that the degree of operating leverage is 2. (leave no cells blank - be certain to enter "0" wherever required. do not round intermediate calculations. enter your answers in millions.) a. what will profits be if sales turn out to be $1.5 million?

Answers: 3

Business, 22.06.2019 20:40, chelsea73

Owns a machine that can produce two specialized products. production time for product tlx is two units per hour and for product mtv is four units per hour. the machine’s capacity is 2,100 hours per year. both products are sold to a single customer who has agreed to buy all of the company’s output up to a maximum of 3,570 units of product tlx and 1,610 units of product mtv. selling prices and variable costs per unit to produce the products follow. product tlx product mtv selling price per unit $ 11.50 $ 6.90 variable costs per unit 3.45 4.14 determine the company's most profitable sales mix and the contribution margin that results from that sales mix.

Answers: 3

Do you know the correct answer?

Maben Company was started on January 1, Year 1, and experienced the following events during its firs...

Questions in other subjects:

Mathematics, 08.04.2021 16:50

Mathematics, 08.04.2021 16:50

Mathematics, 08.04.2021 16:50

Mathematics, 08.04.2021 16:50