Business, 06.05.2020 05:43, george27212

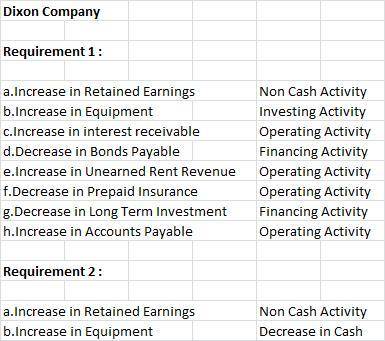

Analyzing Balance Sheet Accounts A review of the balance sheet of Dixon Company revealed the following changes in the account balances: Required: 1. Classify each change in the balance sheet account as a cash flow from operating activities, a cash flow from investing activities, a cash flow from financing activities, or a noncash investing and financing activity. a. Increase in retained earnings b. Increase in equipment c. Increase in interest receivable d. Decrease in bonds payable e. Increase in unearned rent revenue f. Decrease in prepaid insurance g. Decrease in long-term investment h. Increase in accounts payable 2. Indicate whether each of the changes in the balance sheet accounts produces an increase in cash, produces a decrease in cash, or is a noncash activity. a. Increase in retained earnings b. Increase in equipment c. Increase in interest receivable d. Decrease in bonds payable e. Increase in unearned rent revenue f. Decrease in prepaid insurance g. Decrease in long-term investment h. Increase in accounts payable

Answers: 3

Other questions on the subject: Business

Business, 21.06.2019 21:00, july00

Accublade castings inc. casts blades for turbine engines. within the casting department, alloy is first melted in a crucible, then poured into molds to produce the castings. on may 1, there were 230 pounds of alloy in process, which were 60% complete as to conversion. the work in process balance for these 230 pounds was $32,844, determined as follows: exercises during may, the casting department was charged $350,000 for 2,500 pounds of alloy and $19,840 for direct labor. factory overhead is applied to the department at a rate of 150% of direct labor. the department transferred out 2,530 pounds of finished castings to the machining department. the may 31 inventory in process was 44% complete as to conversion. prepare the following may journal entries for the casting department: the materials charged to production the conversion costs charged to production the completed production transferred to the machining department determine the work in process"casting department may 31 balance.

Answers: 1

Business, 22.06.2019 07:30, xmanavongrove55

Suppose a firm faces a fixed price of output, 푝푝= 1200. the firm hires workers from a union at a daily wage, 푤푤, to produce output according to the production function 푞푞= 2퐸퐸12. there are 225 workers in the union. any union worker who does not work for this firm is guaranteed to find nonunion employment at a wage of $96 per day. a. what is the firm’s labor demand function? b. if the firm is allowed to choose 푤푤, but then the union decides how many workers to provide (up to 225) at that wage, what wage will the firm set? how many workers will the union provide? what is the firm’s output and profit? what is the total income of the 225 union workers? c. now suppose that the union sets the wage, but the firm decides how many workers to hire at that wage (up to 225). what wage will the union set to maximize the total income of all 225 workers? how many workers will the firm hire? what is the firm’s output and profit? what is the total income of the 225 union workers? [hint: to maximize total income of union, take the first order condition with respect to w and set equal to 0.]

Answers: 3

Business, 23.06.2019 06:10, lilymoniquesalaiz

Which of the following functions finds the highest value of selected inputs? a. high b. hvalue c. max

Answers: 3

Do you know the correct answer?

Analyzing Balance Sheet Accounts A review of the balance sheet of Dixon Company revealed the followi...

Questions in other subjects:

History, 12.08.2020 07:01

Social Studies, 12.08.2020 07:01