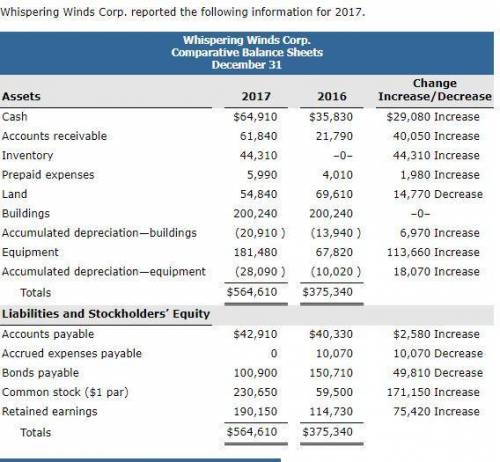

Whispering Winds Corp. Income Statement For the Year Ended December 31, 2017 Sales revenue Cost of goods sold Operating expenses Interest expense Loss on disposal of equipment Income before income taxes Income tax expense Net income $941,820 $472,100 229,800 11,970 2,020 715,890 225,930 64,830 $161,100 Additional information: 1. Operating expenses include depreciation expense of $40,160 2. Land was sold at its book value for cash. 3. Cash dividends of $85,680 were declared and paid in 2017 4. Equipment with a cost of $164,450 was purchased for cash. Equipment with a cost of $50,790 and a book value of $35,670 was sold for $33,650 cash. 5. Bonds of $49,810 were redeemed at their face value for cash. 6. Common stock ($1 par) of $171,150 was issued for cash.

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 01:30, bigsmokedagangsta

Iam trying to get more members on my blog. how do i do that?

Answers: 2

Business, 22.06.2019 19:00, jediDR

Tri fecta, a partnership, had revenues of $369,000 in its first year of operations. the partnership has not collected on $45,000 of its sales and still owes $39,500 on $155,000 of merchandise it purchased. there was no inventory on hand at the end of the year. the partnership paid $27,000 in salaries. the partners invested $48,000 in the business and $23,000 was borrowed on a five-year note. the partnership paid $2,070 in interest that was the amount owed for the year and paid $9,500 for a two-year insurance policy on the first day of business. compute net income for the first year for tri fecta.

Answers: 2

Business, 22.06.2019 20:00, enriqueliz1680

Beranek corp has $720,000 of assets, and it uses no debt--it is financed only with common equity. the new cfo wants to employ enough debt to raise the debt/assets ratio to 40%, using the proceeds from borrowing to buy back common stock at its book value. how much must the firm borrow to achieve the target debt ratio? a. $273,600b. $288,000c. $302,400d. $317,520e. $333,396

Answers: 3

Do you know the correct answer?

Whispering Winds Corp. Income Statement For the Year Ended December 31, 2017 Sales revenue Cost of g...

Questions in other subjects:

Mathematics, 27.03.2020 21:43

Advanced Placement (AP), 27.03.2020 21:43

Mathematics, 27.03.2020 21:43

Biology, 27.03.2020 21:43

Mathematics, 27.03.2020 21:43