Business, 05.05.2020 08:50, tikirawallace

Suppose that two Japanese companies, Hitachi and Toshiba, are the sole producers (i. e., duopolists) of a microprocessor chip used in a number of different brands of personal computers. Assume that the total demand for the chips is fixed and that each firm charges the same price for the chips. Each firm’s market share and profits are a function of the magnitude of the promotional campaign used to promote its version of the chip. Also assume that only two strategies are available to each firm: a limited promotional campaign (budget) and an extensive promotional campaign (budget). If the two firms engage in a limited promotional campaign, each firm will earn a quarterly profit of $11 million. If the two firms undertake an extensive promotional campaign, each firm will earn a quarterly profit of $8 million. With this strategy combination, market share and total sales will be the same as for a limited promotional campaign, but promotional costs will be higher and hence profits will be lower. If either firm engages in a limited promotional campaign and the other firm undertakes an extensive promotional campaign, then the firm that adopts the extensive campaign will increase its market share and earn a profit of $16 million, whereas the firm that chooses the limited campaign will earn a profit of only $4 million.

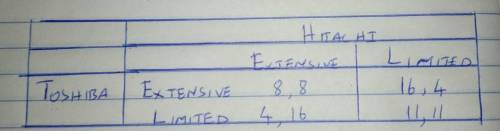

a. Develop a payoff matrix for this decision-making problem.

b. In the absence of a binding and enforceable agreement, determine the dominant advertising strategy and the minimum payoff for Hitachi.

c. Determine the dominant advertising strategy and the minimum payoff for Toshiba

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 11:50, adrianmelchor146

The following are the current month's balances for abc financial services, inc. before preparing the trial balance. accounts payable $ 10,000 revenue 6,000 cash 3,000 expenses 17,500 furniture 10,000 accounts receivable 14,000 common stock ? notes payable 6,500 what amount should be shown for common stock on the trial balance? a. $48.000b. $12.500c. $27.000d. $28.000

Answers: 3

Business, 22.06.2019 14:50, QuarkyFermion

Pear co.’s income statement for the year ended december 31, as prepared by pear’s controller, reported income before taxes of $125,000. the auditor questioned the following amounts that had been included in income before taxes: equity in earnings of cinn co. $ 40,000 dividends received from cinn 8,000 adjustments to profits of prior years for arithmetical errors in depreciation (35,000) pear owns 40% of cinn’s common stock, and no acquisition differentials are relevant. pear’s december 31 income statement should report income before taxes of

Answers: 3

Business, 22.06.2019 19:10, lizzlegnz999

After the price floor is instituted, the chairman of productions office buys up any barrels of gosum berries that the producers are not able to sell. with the price floor, the producers sell 300 barrels per month to consumers, but the producers, at this high price floor, produce 700 barrels per month. how much producer surplus is created with the price floor? show your calculations.

Answers: 2

Business, 22.06.2019 20:20, martinezarielys17

As you have noticed, the demand for flip phones has drastically reduced, and there are only a few consumer electronics companies selling them at extremely low prices. also, the current buyers of flip phones are mainly categorized under laggards. which of the following stages of the industry life cycle is the flip phone industry in currently? a. growth stage b. maturity stage c. decline stage d. commercialization stage

Answers: 2

Do you know the correct answer?

Suppose that two Japanese companies, Hitachi and Toshiba, are the sole producers (i. e., duopolists)...

Questions in other subjects: