Business, 05.05.2020 16:15, apreston2882

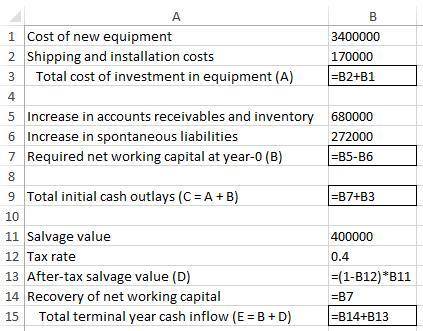

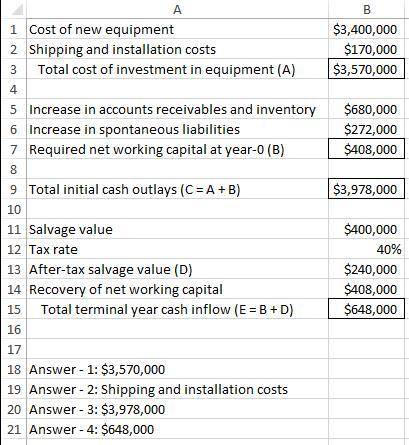

Alexander Industries is considering a project that requires an investment in new equipment of $3,400,000, with an additional $170,000 in shipping and installation costs. Alexander estimates that its accounts receivable and inventories need to increase by $680,000 to support the new project, some of which is financed by a $272,000 increase in spontaneous liabilities (accounts payable and accruals). and consists of the price of the new equipment plus The total cost of Alexander's new equipment is In contrast, Alexander's initial investment Suppose Alexander's new equipment is expected to sell for $400,000 at the end of its four-year useful life, and at the same time, the firm expects to recover all of its net working capital investment. The company chose to use straight-line depreciation, and the new equipment was fully depreciated by the end of its useful life. If the firm's tax rate is 40%, what is the project's total termination cash flow?

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 04:10, jennifer9983

Oakmont company has an opportunity to manufacture and sell a new product for a four-year period. the company’s discount rate is 18%. after careful study, oakmont estimated the following costs and revenues for the new product: cost of equipment needed $ 230,000 working capital needed $ 84,000 overhaul of the equipment in year two $ 9,000 salvage value of the equipment in four years $ 12,000 annual revenues and costs: sales revenues $ 400,000 variable expenses $ 195,000 fixed out-of-pocket operating costs $ 85,000 when the project concludes in four years the working capital will be released for investment elsewhere within the company. click here to view exhibit 12b-1 and exhibit 12b-2, to determine the appropriate discount factor(s) using tables.

Answers: 2

Business, 22.06.2019 14:50, kianofou853

Ann chovies, owner of the perfect pasta pizza parlor, uses 20 pounds of pepperoni each day in preparing pizzas. order costs for pepperoni are $10.00 per order, and carrying costs are 4 cents per pound per day. lead time for each order is three days, and the pepperoni itself costs $3.00 per pound. if she were to order 80 pounds of pepperoni at a time, what would be the average inventory level?

Answers: 3

Business, 22.06.2019 15:30, barstr9146

Brenda wants a new car that will be dependable transportation and look good. she wants to satisfy both functional and psychological needs. true or false

Answers: 1

Do you know the correct answer?

Alexander Industries is considering a project that requires an investment in new equipment of $3,400...

Questions in other subjects:

Mathematics, 27.09.2020 01:01

Health, 27.09.2020 01:01

History, 27.09.2020 01:01

World Languages, 27.09.2020 01:01