Headland Company sponsors a defined benefit pension plan for its employees. The following data relate to the operation of the plan for the years 2020 and 2021.

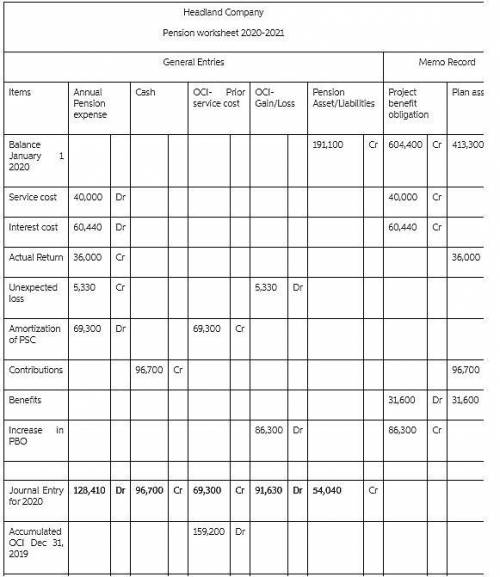

2020

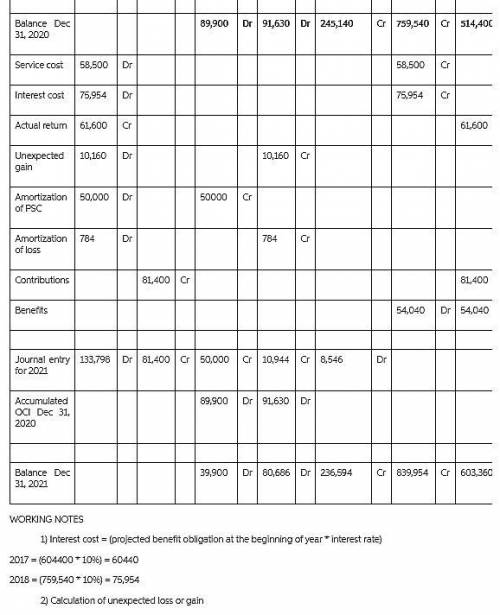

2021

Projected benefit obligation, January 1 $604,400

Plan assets (fair value and market-related value), January 1 413,300

Pension asset/liability, January 1 191,100 Cr.

Prior service cost, January 1 159,200

Service cost 40,000 $58,500

Settlement rate 10 % 10 %

Expected rate of return 10 % 10 %

Actual return on plan assets 36,000 61,600

Amortization of prior service cost 69,300 50,000

Annual contributions 96,700 81,400

Benefits paid retirees 31,600 54,040

Increase in projected benefit obligation due to changes in actuarial assumptions 86,300 0

Accumulated benefit obligation at December 31 722,000 792,600

Average service life of all employees 20 years

Vested benefit obligation at December 31

465,900

1.Prepare a pension worksheet presenting both years 2020 and 2021.

2.

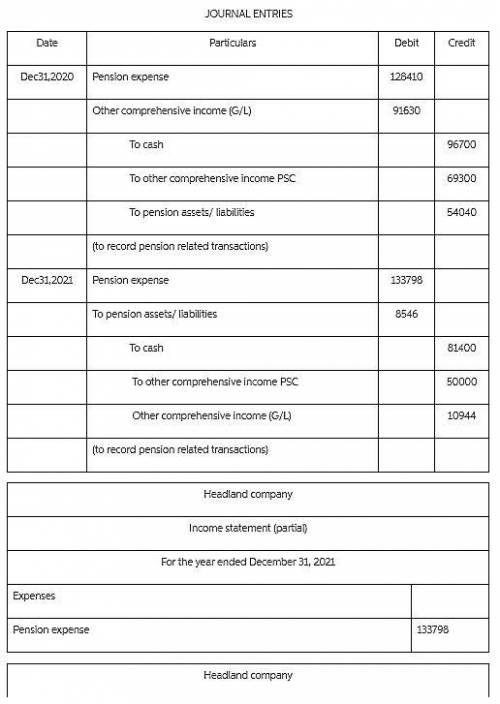

Prepare the journal entries (from the worksheet) to reflect all pension plan transactions and events at December 31 of each year.

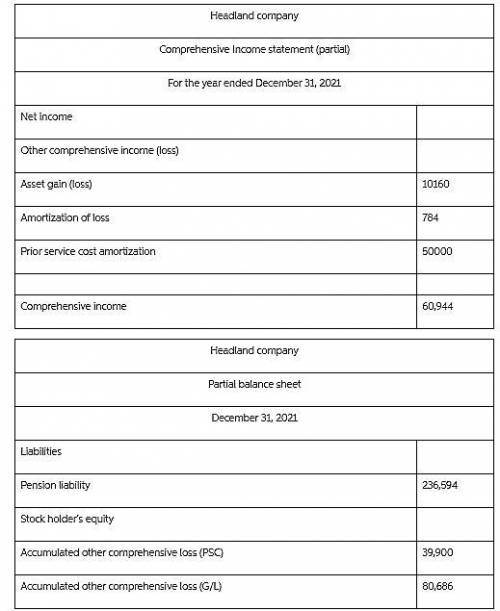

3. For 2021, indicate the pension amounts reported in the financial statements.

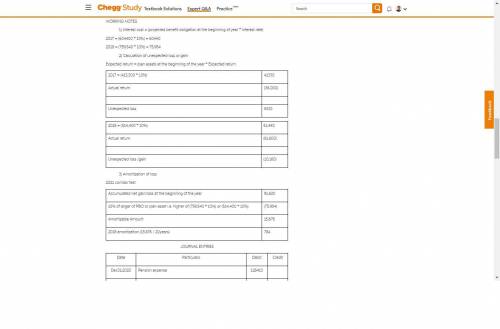

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 20:30, Juniyahodge

He management's discussion and analysis (md& a) required in general purpose federal financial reporting is different than that required by gasb of state and local governments in that: a. it includes information about the agency's performance goals and results in addition to financial activities. b. it is outside the general purpose federal financial report and is optional, not required. c. it is a part of the basic financial statements and, as a result, it is audited along with the financial statements. d. there are no significant differences.

Answers: 2

Business, 22.06.2019 15:50, fireemblam101ovu1gt

Evaluate a real situation between two economic actors; it could be any scenario: two competing businesses, two countries in negotiations, two kids trading baseball cards, you and another person involved in an exchange or anything else. use game theory to analyze the situation and the outcome (or potential outcome). be sure to explain the incentives, benefits and risks each face.

Answers: 1

Business, 22.06.2019 17:00, vistagallosky

Which represents a surplus in the market? a market price equals equilibrium price. b quantity supplied is greater than quantity demanded. c market price is less than equilibrium price. d quantity supplied equals quantity demanded.

Answers: 2

Business, 22.06.2019 18:50, gucc4836

Retirement investment advisors, inc., has just offered you an annual interest rate of 4.4 percent until you retire in 40 years. you believe that interest rates will increase over the next year and you would be offered 5 percent per year one year from today. if you plan to deposit $13,000 into the account either this year or next year, how much more will you have when you retire if you wait one year to make your deposit?

Answers: 3

Do you know the correct answer?

Headland Company sponsors a defined benefit pension plan for its employees. The following data relat...

Questions in other subjects:

Biology, 17.02.2021 17:30

Mathematics, 17.02.2021 17:30

Geography, 17.02.2021 17:30

Chemistry, 17.02.2021 17:30

Mathematics, 17.02.2021 17:30