Business, 05.05.2020 22:03, korar87181

Shamrock enters into an agreement with Traveler Inc. to lease a car on December 31, 2016. The following information relates to this agreement.

1. The term of the non-cancelable lease is 4 years with no renewal or bargain purchase option. The remaining economic life of the car is 3 years, and it is expected to have no residual value at the end of the lease term.

2. The fair value of the car was $14,000 at commencement of the lease.

3. Annual payments are required to be made on December 31 at the end of each year of the lease, beginning December 31, 2017. The first payment is to be of an amount of $5,182.80, with each payment increasing by a constant rate of 5% from the previous payment (i. e., the second payment will be $5,441.94 and the third and final payment will be $5,714.04).

4. Shamrock’ incremental borrowing rate is 8%. The rate implicit in the lease is unknown.

5. Shamrock uses straight-line depreciation for all similar cars.

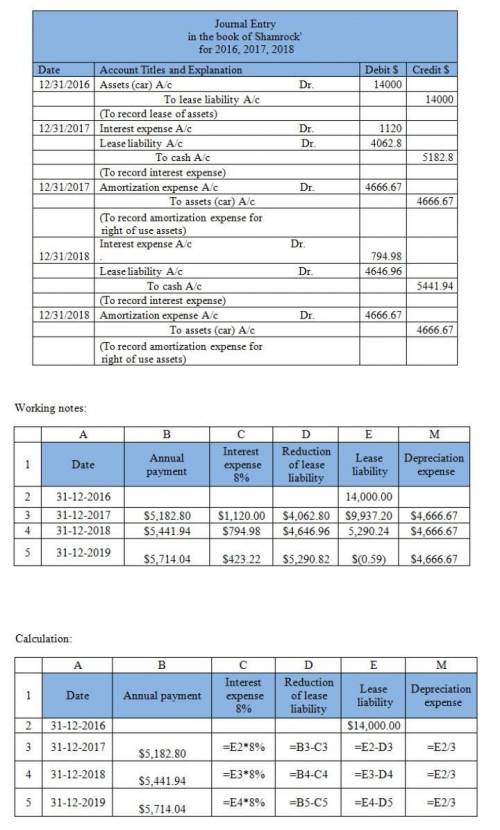

Prepare Shamrock’ journal entries for 2016, 2017, and 2018. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. For calculation purposes, use 5 decimal places as displayed in the factor table provided and round final answers to 2 decimal places, e. g. 5,275.25.)

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 03:30, autumnxng3094

Lindon company is the exclusive distributor for an automotive product that sells for $30.00 per unit and has a cm ratio of 30%. the company’s fixed expenses are $162,000 per year. the company plans to sell 20,200 units this year. required: 1. what are the variable expenses per unit? (round your "per unit" answer to 2 decimal places.) 2. what is the break-even point in unit sales and in dollar sales? 3. what amount of unit sales and dollar sales is required to attain a target profit of $72,000 per year? 4. assume that by using a more efficient shipper, the company is able to reduce its variable expenses by $3.00 per unit. what is the company’s new break-even point in unit sales and in dollar sales? what dollar sales is required to attain a target profit of $72,000?

Answers: 2

Business, 22.06.2019 17:20, shakira11harvey6

Andy owns islander surfboard inc. in the past, andy has always given his employees bonuses during the holidays if they reached certain sales goals. this year, even though the company is thriving, he decided to cut bonuses from employees and award them to himself instead. what ethical theory of leadership is andy following?

Answers: 1

Business, 22.06.2019 20:40, MyaMya12

Asmall town wants to build some new recreational facilities. the proposed facilities include a swimming pool, recreation center, basketball court and baseball field. the town council wants to provide the facilities which will be used by the most people, but they face budget and land limitations. the town has $400,000 and 14 acres of land. the pool requires locker facilities which would be in the recreation center, so if the swimming pool is built the recreation center must also be built. also, the council has only enough flat land to build the basketball court or the baseball field. the daily usage and cost of the facilities (in $1,000) are shown below. which facilities should they build? facilityusagecost ($1,000)landswimming pool4001002recreation center5002003basketball court3001504baseball field2001005

Answers: 1

Business, 22.06.2019 21:30, schneidersamant9242

Which is cheaper: eating out or dining in? the mean cost of a flank steak, broccoli, and rice bought at the grocery store is $13.04 (money. msn website, november 7, 2012). a sample of 100 neighborhood restaurants showed a mean price of $12.75 and a standard deviation of $2 for a comparable restaurant meal. a. develop appropriate hypotheses for a test to determine whether the sample data support the conclusion that the mean cost of a restaurant meal is less than fixing a comparable meal at home. b. using the sample from the 100 restaurants, what is the p-value? c. at a = .05, what is your conclusion? d. repeat the preceding hypothesis test using the critical value approach

Answers: 3

Do you know the correct answer?

Shamrock enters into an agreement with Traveler Inc. to lease a car on December 31, 2016. The follow...

Questions in other subjects:

Mathematics, 23.10.2020 21:10

Mathematics, 23.10.2020 21:10

Mathematics, 23.10.2020 21:10