Business, 06.05.2020 01:57, krystenlitten

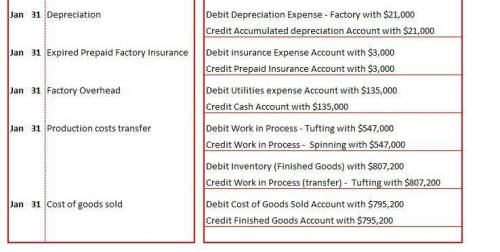

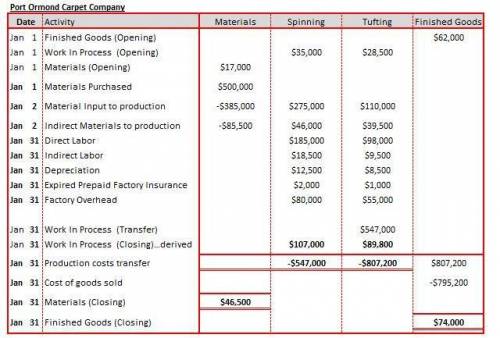

Port Ormond Carpet Company manufactures carpets. Fiber is placed in process in the Spinning Department, where it is spun into yarn. The output of the Spinning Department is transferred to the Tufting Department, where carpet backing is added at the beginning of the process and the process is completed. On January 1, Port Ormond Carpet Company had the following inventories:Finished Goods $62,000Work in Process-Spinning Department 35,000Work in Process-Tufting Department 28,500Materials 17,000Departmental accounts are maintained for factory overhead, and both have zero balances on January 1. Manufacturing operations for January are summarized as follows:Jan. 1 Materials purchased on account, $500,0002 Materials requisitioned for use:Fiber-Spinning Department, $275,000Carpet backing-Tufting Department, $110,000Indirect materials-Spinning Department, $46,000Indirect materials-Tufting Department, $39,50031 Labor used:Direct labor-Spinning Department, $185,000Direct labor-Tufting Department, $98,000Indirect labor-Spinning Department, $18,500Indirect labor-Tufting Department, $9,00031 Depreciation charged on fixed assets:Spinning Department, $12,500Tufting Department, $8,50031 Expired prepaid factory insurance:Spinning Department, $2,000Tufting Department, $1,00031 Applied factory overhead:Spinning Department, $80,000Tufting Department, $55,00031 Production costs transferred from Spinning Department to Tufting Department, $547,00031 Production costs transferred from Tufting Department to Finished Goods, $807,20031 Cost of goods sold during the period, $795,200Required:1. Journalize the entries to record the operations, using the dates provided with the summary of manufacturing operations. Refer to the Chart of Accounts for exact wording of account titles.2. Compute the January 31 balances of the inventory accounts.*3. Compute the January 31 balances of the factory overhead accounts.*

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 22:50, Zagorodniypolina5

Tara incorporates her sole proprietorship, transferring it to newly formed black corporation. the assets transferred have an adjusted basis of $240,000 and a fair market value of $300,000. also transferred was $10,000 in liabilities, $1,000 of which was personal and the balance of $9,000 being business related. in return for these transfers, tara receives all of the stock in black corporation. a. black corporation has a basis of $241,000 in the property. b. black corporation has a basis of $240,000 in the property. c. tara’s basis in the black corporation stock is $241,000. d. tara’s basis in the black corporation stock is $249,000. e. none of the above.

Answers: 1

Business, 23.06.2019 02:00, SSE4802

Imprudential, inc., has an unfunded pension liability of $572 million that must be paid in 25 years. to assess the value of the firm’s stock, financial analysts want to discount this liability back to the present. if the relevant discount rate is 6.5 percent, what is the present value of this liability? (do not round intermediate calculations and enter your answer in dollars, not millions, rounded to 2 decimal places, e. g., 1,234,567.89)

Answers: 3

Business, 23.06.2019 02:40, laura1649

P8-4b dropping unfavorable division based on the following analysis of last year's operations of groves, inc., a financial vice president of the company believes that the firm's total net income could be increased by $160,000 if its design division were discontinued. (amounts are given in the thousands of dollars.) required provide answers for each of the following independent situations: a. assuming that total fixed costs and expenses would not be affected by discontinuing the design division, prepare an analysis showing why you agree or disagree with the vice president. b. assume that the discontinuance of the design division will enable the company to avoid 30% of the fixed portion of cost of services and 40% of the fixed operating expenses allocated to the design division. calculate the resulting effect on net income. c. assume that in addition to the cost avoidance in requirement (b), the capacity released by discontinuance of the design division can be used to provide 6,000 new services that would have a variable cost per service of $60 and would require additional fixed costs totaling $68,000. at what unit price must the new service be sold if groves is to increase its total net income by $180,000?

Answers: 2

Do you know the correct answer?

Port Ormond Carpet Company manufactures carpets. Fiber is placed in process in the Spinning Departme...

Questions in other subjects:

Mathematics, 14.04.2020 22:36

Mathematics, 14.04.2020 22:37

English, 14.04.2020 22:37