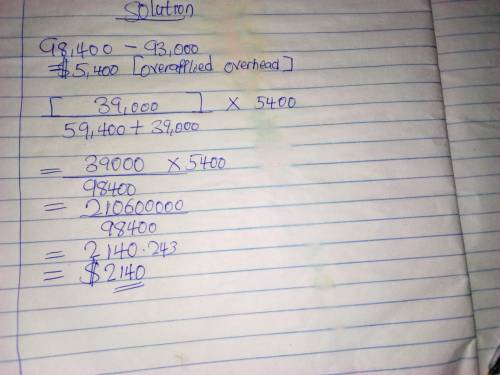

Before prorating the manufacturing overhead costs at the end of 2020, the Cost of Goods Sold and Finished Goods Inventory accounts had applied overhead costs of $59,400 and $39,000 in them, respectively. There was no Work-in-Process at the beginning or end of 2020. During the year, manufacturing overhead costs of $93,000 were actually incurred. The balance in the Applied Manufacturing Overhead was $98,400 at the end of 2020. If the under- or overapplied overhead is prorated between Cost of Goods Sold and the inventory accounts, what will be the Cost of Goods Sold balance after the proration

a.$913.

b.$1,228.

c.$2,637.

d.$955

Answers: 3

Other questions on the subject: Business

Business, 21.06.2019 16:10, lalaboooobooo

Acustomer has come to your department with an urgent question. you promised her that you would collect information about her question and answer it by noon. it will take you at least 20 minutes to gather the information needed to provide an answer. it is now 11: 50 a. m. your supervisor just scheduled a 30-minute meeting to start at noon. this meeting is for all employees in your department. you decide to:

Answers: 2

Business, 21.06.2019 22:00, mpete1234567890

Select the correct answers. mila is at a flea market. she has $50 in her wallet. she decides that she will spend $15 on jewelry, $20 on a pair of jeans, $5 on a t-shirt, and $10 on something to eat. she likes a one-of-a-kind t-shirt, but the seller is not ready to sell it for less than $8. she thinks of five ways to deal with this situation. which two choices indicate a trade-off?

Answers: 3

Business, 22.06.2019 17:30, chrisd2432

Alinguist had a gross income of 53,350 last year. if 17.9% of his income got witheld for federal income tax, how much of the linguist's pay got witheld for federal income tax last year?

Answers: 2

Business, 22.06.2019 19:20, needhelp243435

This problem has been solved! see the answerwhich of the following statements is correct? the consumer price index is a measure of the overall level of prices, whereas the gdp deflator is not a measure of the overall level of prices. if, in the year 2011, the consumer price index has a value of 123.50, then the inflation rate for 2011 must be 23.50 percent. compared to the gdp deflator, the consumer price index is the more common gauge of inflation. the consumer price index and the gdp deflator reflect the goods and services bought by consumers equally well.

Answers: 2

Do you know the correct answer?

Before prorating the manufacturing overhead costs at the end of 2020, the Cost of Goods Sold and Fin...

Questions in other subjects:

Mathematics, 04.07.2019 22:00

English, 04.07.2019 22:00

Mathematics, 04.07.2019 22:00

Mathematics, 04.07.2019 22:00