Business, 06.05.2020 04:22, baseball1525

Betty Cooker runs a bakery in San Francisco that specializes in her famous Black Forest cakes. These cakes come with four kinds of frostings: vanilla, chocolate, raspberry and devilicious. She estimates that the daily demand for each type of cake is independent and is normally distributed with a mean of 50 and a standard deviation of 20. Each customer wants to buy exactly one cake. Customers who favor a particular type of frosting will not buy any other if their preferred frosting is out of stock. Every day in the morning, Betty Cooker and her team of bakers prepare a fresh batch of the cakes for sale that day. Her costs to bake and top each cake are $5. Each cake sells for $15. Betty's Bakery prides itself on its fresh assortment, so cakes not sold by the end of that day are given away to a soup kitchen for the homeless.

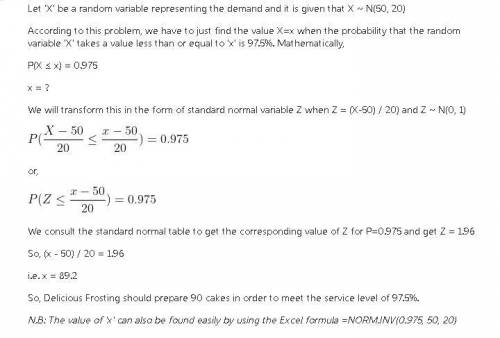

Suppose Betty wants to bake enough cakes so that she can be 97.5% sure that she can satisfy the demand for all of her customers. How many cakes with Devilicious frosting should she prepare daily in the morning?

Answers: 2

Other questions on the subject: Business

Business, 21.06.2019 16:30, makaylapink8167

Calculate the required rate of return for an asset that has a beta of 1.73, given a risk-free rate of 5.3% and a market return of 9.9%. b. if investors have become more risk-averse due to recent geopolitical events, and the market return rises to 12.7%, what is the required rate of return for the same asset?

Answers: 2

Business, 21.06.2019 20:30, saltyclamp

Max fischer is a beekeeper. his annual group insurance costs 11,700. his employer pays 60% of the cost. how much does max pay semimonthly for it?

Answers: 1

Business, 22.06.2019 08:00, kingyogii

Suppose that xtel currently is selling at $40 per share. you buy 500 shares using $15,000 of your own money, borrowing the remainder of the purchase price from your broker. the rate on the margin loan is 8%. a. what is the percentage increase in the net worth of your brokerage account if the price of xtel immediately changes to (a) $44; (b) $40; (c) $36? (leave no cells blank - be certain to enter "0" wherever required. negative values should be indicated by a minus sign. round your answers to 2 decimal places.) b. if the maintenance margin is 25%, how low can xtel’s price fall before you get a margin call? (round your answer to 2 decimal places.) c. how would your answer to requirement 2 would change if you had financed the initial purchase with only $10,000 of your own money? (round your answer to 2 decimal places.) d. what is the rate of return on your margined position (assuming again that you invest $15,000 of your own money) if xtel is selling after one year at (a) $44; (b) $40; (c) $36? (negative values should be indicated by a minus sign. round your answers to 2 decimal places.) e. continue to assume that a year has passed. how low can xtel’s price fall before you get a margin call? (round your answer to 2 decimal places.)

Answers: 1

Do you know the correct answer?

Betty Cooker runs a bakery in San Francisco that specializes in her famous Black Forest cakes. These...

Questions in other subjects:

Mathematics, 10.05.2021 21:40

Mathematics, 10.05.2021 21:40

Physics, 10.05.2021 21:40

Spanish, 10.05.2021 21:40

Mathematics, 10.05.2021 21:40

Mathematics, 10.05.2021 21:40