Financial data for Joel de Paris, Inc., for last year follow: Joel de Paris, Inc. Balance Sheet Beginning Balance Ending Balance Assets Cash $ 132,000 $ 137,000 Accounts receivable 330,000 483,000 Inventory 573,000 476,000 Plant and equipment, net 845,000 824,000 Investment in Buisson, S. A. 397,000 431,000 Land (undeveloped) 248,000 251,000 Total assets $ 2,525,000 $ 2,602,000 Liabilities and Stockholders' Equity Accounts payable $ 385,000 $ 341,000 Long-term debt 1,014,000 1,014,000 Stockholders' equity 1,126,000 1,247,000 Total liabilities and stockholders' equity $ 2,525,000 $ 2,602,000 Joel de Paris, Inc. Income Statement Sales $ 4,180,000 Operating expenses 3,553,000 Net operating income 627,000 Interest and taxes: Interest expense $ 116,000 Tax expense 201,000 317,000 Net income $ 310,000 The company paid dividends of $189,000 last year. The "Investment in Buisson, S. A.," on the balance sheet represents an investment in the stock of another company. The company's minimum required rate of return of 15%.

Required:

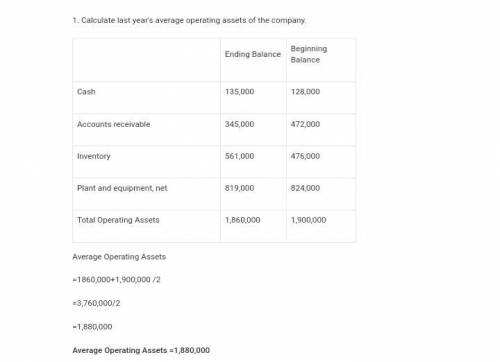

1. Compute the company's average operating assets for last year.

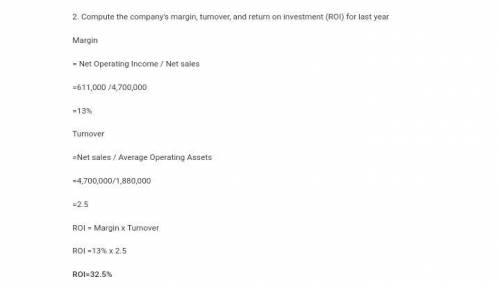

2. Compute the company’s margin, turnover, and return on investment (ROI) for last year. (Round "Margin", "Turnover" and "ROI" to 2 decimal places.)

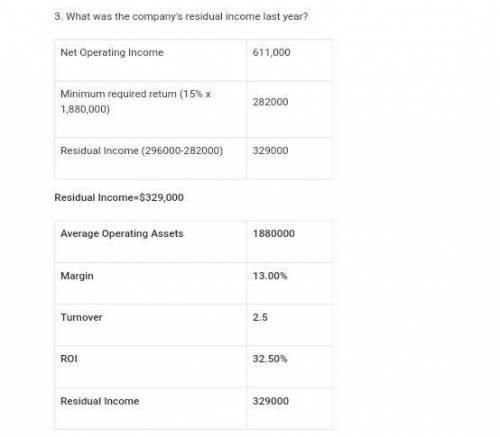

3. What was the company’s residual income last year?

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 20:30, jackiecroce1

Which of the following best describes the purpose of raising and lowering the required reserve ratio? a. to make sure that government spending does not result in either a surplus or deficit. b. to stimulate economic growth by making it less expensive for producers to get loans. c. to manage the economy by increasing or decreasing the amount of loans being made. d. to regulate the activity of private banks to assure an equitable distribution of wealth. 2b2t

Answers: 3

Business, 21.06.2019 22:40, itscheesycheedar

In allentown, pennsylvania, in the summer of 2014, the average price of a gallon of gasoline was $3.68long dasha 22-cent increase from the year before. many consumers were upset by the increase. one was quoted in a local newspaper as saying, "it's crazy. the government should step in." source: sam kennedy, "valley feeling pain at the pump," (allentown, pa) morning call, june 21, 2014. suppose the government had stepped in and imposed a price ceiling equal to old price of $3.46 per gallon. a. using the line drawing tool, draw and label the price ceiling. carefully follow the instructions above, and only draw the required object.

Answers: 3

Business, 22.06.2019 08:30, shauntleaning

Match the given situations to the type of risks that a business may face while taking credit. 1. beta ltd. had taken a loan from a bank for a period of 15 years, but its sales are gradually showing a decline. 2. alpha ltd. has taken a loan for increasing its production and sales, but it has not conducted any research before making this decision. 3. delphi ltd. has an overseas client. the economy of the client’s country is going through severe recession. 4. delphi ltd. has taken a short-term loan from the bank, but its supply chain logistics are not in place. a. foreign exchange risk b. operational risk c. term of loan risk d. revenue projections risk

Answers: 3

Business, 22.06.2019 11:30, Coltong121

Buyer henry is going to accept seller shannon's $282,500 counteroffer. when will this counteroffer become a contract. a. counteroffers cannot become contracts b. when henry gives shannon notice of the acceptance c. when henry signs the counteroffer d. when shannon first made the counteroffer

Answers: 3

Do you know the correct answer?

Financial data for Joel de Paris, Inc., for last year follow: Joel de Paris, Inc. Balance Sheet Begi...

Questions in other subjects:

Social Studies, 27.07.2019 12:00

Biology, 27.07.2019 12:00

History, 27.07.2019 12:00

Mathematics, 27.07.2019 12:00