Business, 06.05.2020 08:35, karenlemus4774

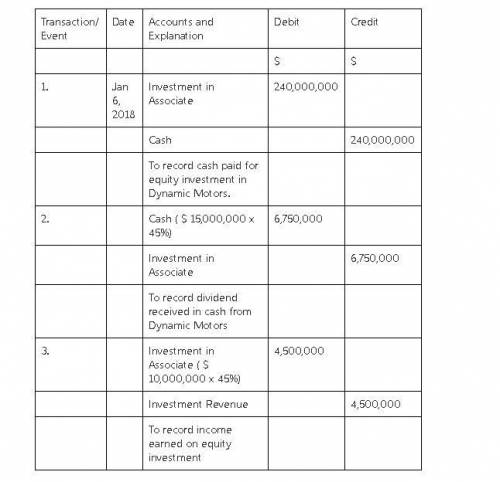

Suppose that on January 6, 2018, Excel Motors paid $240,000,000 for its 45% investment in Dynamic Motors. Excel has significant influence over Dynamic after the purchase. Assume Dynamic earned net income of $10,000,000 and paid cash dividends of $15,000,000 to all outstanding stockholders during 2018. (Assume all outstanding stock is voting stock.) Read the requirements Requirement 1. What method should Excel Motors use to account for the investment in Dynamic Motors? Give your reasoning. Excel Motors should use the ▼ method to account for its investment in Dynamic Motors because the investment Requirement 2. Journalize all required 2018 transactions related to Excel Motors's Dynamic investment.

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 09:40, nessross1018

Salt corporation's contribution margin ratio is 78% and its fixed monthly expenses are $30,000. assume that the company's sales for may are expected to be $89,000. required: estimate the company's net operating income for may, assuming that the fixed monthly expenses do not change.

Answers: 1

Business, 22.06.2019 18:00, slycooper99

During the holiday season, maria's department store works with a contracted employment agency to bring extra workers on board to handle overflow business, and extra duties such as wrapping presents. maria's is using during these rush times.

Answers: 3

Business, 22.06.2019 19:50, annabanana1298

Juan's investment portfolio was valued at $125,640 at the beginning of the year. during the year, juan received $603 in interest income and $298 in dividend income. juan also sold shares of stock and realized $1,459 in capital gains. juan's portfolio is valued at $142,608 at the end of the year. all income and realized gains were reinvested. no funds were contributed or withdrawn during the year. what is the amount of income juan must declare this year for income tax purposes?

Answers: 1

Business, 23.06.2019 01:00, alyo31500

Ido not understand this project overview agricultural commodities are bought and sold through the stock exchange. the price of commodities changes all the time. investors buy many agricultural commodities before they are ready for shipping. when an investor buys an agricultural commodity that is going to be ready in the future, they call this purchasing futures. this might be a future crop, meat that has not yet been processed, or another type of agricultural commodity. for this project, you will have to decide how to spend $10,000. research the new york stock exchange. find one or more agricultural commodities that you are interested in. remember, it may be listed as a future crop. instructions identify the agricultural commodities that you think have the best chance of going up in price. think about what is going on with supply and demand. decide how you will spend your money. you may purchase only agricultural commodities. check the market every day for a week. record the price of your commodity or commodities each day. you may buy or sell your commodities at any time during the week. you may sell your commodities and buy different ones. feel free to experiment with the $10,000 by buying and selling commodities, but make sure to keep a careful record of your activities. at the end of the week, you will write a report on your investments. this report should be structured to include this information: page 1: explain how the stock market works. page 2: list all commodities purchased. describe each in detail. discuss why you selected these commodities. remember, they must be agricultural. page 3: create a chart or graph to illustrate the price of your commodity or commodities over the week’s time. list all of your activity buying and selling. make sure you include prices and details. page 4: write a summary of your experience. describe what you might do differently if you were using actual money. propose potential reasons why the price of each commodity may go up or down.

Answers: 1

Do you know the correct answer?

Suppose that on January 6, 2018, Excel Motors paid $240,000,000 for its 45% investment in Dynamic Mo...

Questions in other subjects:

English, 29.01.2021 16:10

Mathematics, 29.01.2021 16:10

Mathematics, 29.01.2021 16:10

Arts, 29.01.2021 16:10

Mathematics, 29.01.2021 16:10