Business, 25.04.2020 05:02, sujeyribetanco2216

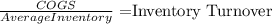

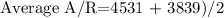

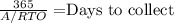

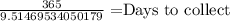

Cola Inc. Soda Co. Fiscal Year Ended: 2015 2014 2013 2015 2014 2013 Net Sales $ 39,819 $ 35,690 $ 36,444 $ 62,438 $ 47,932 $ 47,751 Accounts Receivable 4,588 3,903 3,231 6,557 4,804 3,874 Allowance for Doubtful Accounts 57 64 60 153 99 79 Accounts Receivable, Net of Allowance 4,531 3,839 3,171 6,404 4,705 3,795 Required: Calculate the receivables turnover ratios and days to collect for Cola Inc. and Soda Co. for 2015 and 2014. (Use 365 days in a year. Do not round intermediate calculations on Accounts Receivable Turnover Ratio. Round your final answers to 1 decimal place. Use final rounded answers from Accounts Receivable Turnover Ratio for Days to Collect ratio calculation.)

Answers: 3

Other questions on the subject: Business

Business, 21.06.2019 21:00, hannahkharel2

On june 1 of the current year, chad wilson established a business to manage rental property. he completed the following transactions during june: opened a business bank account with a deposit of $28,000 from personal funds. purchased office supplies on account, $2,690. received cash from fees earned for managing rental property, $7,390. paid rent on office and equipment for the month, $3,310. paid creditors on account, $1,230. billed customers for fees earned for managing rental property, $6,130. paid automobile expenses (including rental charges) for the month, $740, and miscellaneous expenses, $370. paid office salaries, $2,330. determined that the cost of supplies on hand was $1,590; therefore, the cost of supplies used was $1,100. withdrew cash for personal use, $2,210. required: 1. indicate the effect of each transaction and the balances after each transaction: for those boxes in which no entry is required, leave the box blank. for those boxes in which you must enter subtractive or negative numbers use a minus sign. (example: -300) answer

Answers: 1

Business, 22.06.2019 12:30, imamnaab5710

Consider a treasury bill with a rate of return of 5% and the following risky securities: security a: e(r) = .15; variance = .0400 security b: e(r) = .10; variance = .0225 security c: e(r) = .12; variance = .1000 security d: e(r) = .13; variance = .0625 the investor must develop a complete portfolio by combining the risk-free asset with one of the securities mentioned above. the security the investor should choose as part of her complete portfolio to achieve the best cal would be a. security a b. security b c. security c d. security d

Answers: 3

Business, 22.06.2019 17:00, HourlongNine342

Serious question, which is preferred in a business? pp or poopoo?

Answers: 1

Do you know the correct answer?

Cola Inc. Soda Co. Fiscal Year Ended: 2015 2014 2013 2015 2014 2013 Net Sales $ 39,819 $ 35,690 $ 36...

Questions in other subjects:

Chemistry, 15.12.2020 03:20

Arts, 15.12.2020 03:20

English, 15.12.2020 03:20

Physics, 15.12.2020 03:20

History, 15.12.2020 03:20