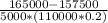

Evan, a single individual, operates a service business that earned $110,000 in 2018. The business has no tangible property and paid no W-2 wages. Compute Evan's QBI deduction, assuming his overall taxable income before QBI is $125,000. Compute Evan's QBI deduction, assuming his overall taxable income before QBI is $165,000.

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 20:40, kaylee0424

Financial performance is measured in many ways. requirements 1. explain the difference between lag and lead indicators. 2. the following is a list of financial measures. indicate whether each is a lag or lead indicator: a. income statement shows net income of $100,000 b. listing of next week's orders of $50,000 c. trend showing that average hits on the redesigned website are increasing at 5% per week d. price sheet from vendor reflecting that cost per pound of sugar for the next month is $2 e. contract signed last month with large retail store that guarantees a minimum shelf space for grandpa's overloaded chocolate cookies for the next year

Answers: 2

Do you know the correct answer?

Evan, a single individual, operates a service business that earned $110,000 in 2018. The business ha...

Questions in other subjects:

Mathematics, 31.03.2021 18:40

Mathematics, 31.03.2021 18:40

Mathematics, 31.03.2021 18:40

Mathematics, 31.03.2021 18:40

Social Studies, 31.03.2021 18:40

Mathematics, 31.03.2021 18:40

Mathematics, 31.03.2021 18:40

(where 20% = 0.2 for easy computation)

(where 20% = 0.2 for easy computation)