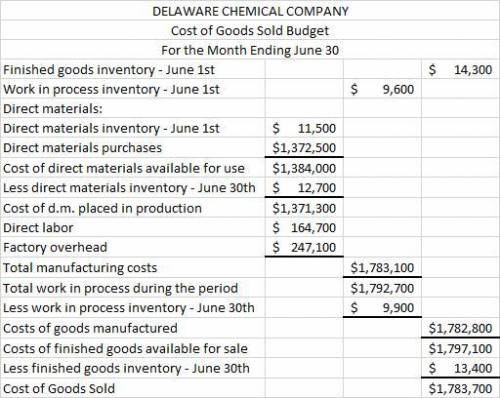

Cost of Goods Sold Budget Delaware Chemical Company uses oil to produce two types of plastic products, P1 and P2. Delaware budgeted 18,300 barrels of oil for purchase in June for $75 per barrel. Direct labor budgeted in the chemical process was $164,700 for June. Factory overhead was budgeted at $247,100 during June. The inventories on June were estimated to be:

Oil $11,500

P1 7,700

P2 6,600

Work in process 9,600

The desired inventories on June 30 were:

Oil $12,700

P1 7,100

P2 6,300

Work in process 9,900

Use the preceding information to prepare a cost of goods sold budget for June. For those boxes in which you must enter subtracted or negative numbers use a minus sign.

Delaware Chemical Company

Cost of Goods Sold Budget

For the Month Ending June 30

_ _ _ $_ _ _

_ _ _ $_ _ _

Direct materials:

_ _ _ $_ _ _

_ _ _ _ _ _

_ _ _ $_ _ _

_ _ _ _ _ _

_ _ _ $_ _ _

_ _ _ _ _ _

_ _ _ _ _ _

_ _ _

$_ _ _

_ _ _

_ _ _

$_ _ _

$_ _ _

$_ _ _

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 01:40, NeverEndingCycle

Suppose general motors demands labor according to the labor demand function 푤푤= 40−0. 5퐸퐸, where 푤푤 is the hourly wage and 퐸퐸 is the number of employees. the united auto workers union has a utility function given by 푈푈=푊푊∗퐸퐸. a. in 1984, the united auto workers union started negotiations with general motors by assuming that they were a monopoly union. find the wage and employment demands that the united auto workers union would have demanded before any bargaining began. b. if general motors and the united auto workers union both had excellent bargaining representatives, would this be the final labor contract? if not, then explain in words and graphically where they would end up after the bargaining process.

Answers: 1

Business, 22.06.2019 08:40, bchagnard2122

Exercise 18-15 sheffield appliance center is an experienced home appliance dealer. sheffield appliance center also offers a number of services for the home appliances that it sells. assume that sheffield appliance center sells ovens on a standalone basis. sheffield appliance center also sells installation services and maintenance services for ovens. however, sheffield appliance center does not offer installation or maintenance services to customers who buy ovens from other vendors. pricing for ovens is as follows. oven only $790 oven with installation service 850 oven with maintenance services 970 oven with installation and maintenance services 990 in each instance in which maintenance services are provided, the maintenance service is separately priced within the arrangement at $180. additionally, the incremental amount charged by sheffield appliance center for installation approximates the amount charged by independent third parties. ovens are sold subject to a general right of return. if a customer purchases an oven with installation and/or maintenance services, in the event sheffield appliance center does not complete the service satisfactorily, the customer is only entitled to a refund of the portion of the fee that exceeds $790. assume that a customer purchases an oven with both installation and maintenance services for $990. (b) indicate the amount of revenue that should be allocated to the oven, the installation, and to the maintenance contract.

Answers: 3

Business, 23.06.2019 03:00, angelapegues20097

Atennis club charges a monthly membership fee of $150 and charges it members $10 per hour to use a court. there's also $500 fee to become a member. stella joined the tennis club last spring, and she has been a member for 5 months. she has been playing 10 hours of tennis each month. stella values an hour of her time at $20. during a boring afternoon meeting, stella thinks about reserving a court to work on her serve for an hour tonight. what's stella's opportunity cost of working on her serve for an hour?

Answers: 1

Business, 23.06.2019 14:30, jonmorton159

The manda panda company uses the allowance method to account for bad debts. at the beginning of 2018, the allowance account had a credit balance of $92,400. credit sales for 2018 totaled $3,190,000 and the year-end accounts receivable balance was $507,500. during this year, $88,500 in receivables were determined to be uncollectible. manda panda anticipates that 3% of all credit sales will ultimately become uncollectible. the fiscal year ends on december 31. required: 1. does this situation describe a loss contingency? 2. what is the bad debt expense that manda panda should report in its 2018 income statement? 3. prepare the appropriate journal entry to record the contingency. 4. complete the table below to calculate the net realizable value manda panda should report in its 2018 balance sheet?

Answers: 2

Do you know the correct answer?

Cost of Goods Sold Budget Delaware Chemical Company uses oil to produce two types of plastic product...

Questions in other subjects:

SAT, 29.07.2019 01:30

Mathematics, 29.07.2019 01:30

Mathematics, 29.07.2019 01:30

Computers and Technology, 29.07.2019 01:30