Business, 25.04.2020 00:34, yassinesayedahmad1

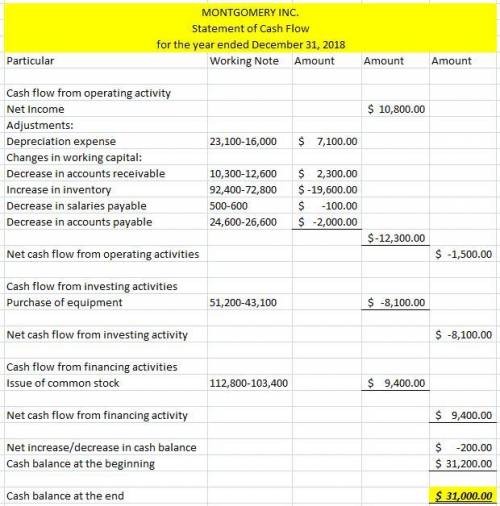

Preparing statement of cash flows LO P1, P2, P3

MONTGOMERY INC.

Comparative Balance Sheets

December 31, 2018 and 2017

2018 2017

Assets

Cash $ 31,000 $ 31,200

Accounts receivable, net 10,300 12,600

Inventory 92,400 72,800

Total current assets 133,700 116,600

Equipment 51,200 43,100

Accum. depreciation—Equipment (23,100) (16,000)

Total assets $ 161,800 $ 143,700

Liabilities and Equity

Accounts payable $ 24,600 $ 26,600

Salaries payable 500 600

Total current liabilities 25,100 27,200

Equity

Common stock, no par value 112,800 103,400

Retained earnings 23,900 13,100

Total liabilities and equity $ 161,800 $ 143,700

MONTGOMERY INC.

Income Statement

For Year Ended December 31, 2018

Sales $ 45,900

Cost of goods sold (19,100)

Gross profit 26,800

Operating expenses

Depreciation expense $ 7,100

Other expenses 5,500

Total operating expense 12,600

Income before taxes 14,200

Income tax expense 3,400

Net income $ 10,800

Additional Information

No dividends are declared or paid in 2018.

Issued additional stock for $9,400 cash in 2018.

Purchased equipment for cash in 2018; no equipment was sold in 2018.

Use the above financial statements and additional information to prepare a statement of cash flows for the year ended December 31, 2018, using the indirect method.

Answers: 2

Other questions on the subject: Business

Business, 21.06.2019 19:20, Lindseycline123

The following selected amounts are reported on the year-end unadjusted trial balance report for a company that uses the percent of sales method to determine its bad debts expense. accounts receivable $ 435,000 debit allowance for doubtful accounts 1,250 debit net sales 2,100,000 credit all sales are made on credit. based on past experience, the company estimates 1.0% of credit sales to be uncollectible. what adjusting entry should the company make at the end of the current year to record its estimated bad debts expense

Answers: 2

Business, 22.06.2019 12:30, bcarri4073

M. cotteleer electronics supplies microcomputer circuitry to a company that incorporates microprocessors into refrigerators and other home appliances. one of the components has an annual demand of 235 units, and this is constant throughout the year. carrying cost is estimated to be $1.25 per unit per year, and the ordering (setup) cost is $21 per order. a) to minimize cost, how many units should be ordered each time an order is placed? b) how many orders per year are needed with the optimal policy? c) what is the average inventory if costs are minimized? d) suppose that the ordering cost is not $21, and cotteleer has been ordering 125 units each time an order is placed. for this order policy (of q = 125) to be optimal, determine what the ordering cost would have to be.

Answers: 1

Business, 22.06.2019 14:30, deku6

United continental holdings, inc., (ual), operates passenger service throughout the world. the following data (in millions) were adapted from a recent financial statement of united. sales (revenue) $38,901 average property, plant, and equipment 17,219 average intangible assets 8,883 1. compute the asset turnover. round your answer to two decimal places.

Answers: 2

Do you know the correct answer?

Preparing statement of cash flows LO P1, P2, P3

MONTGOMERY INC.

Comparative Balanc...

MONTGOMERY INC.

Comparative Balanc...

Questions in other subjects:

Mathematics, 18.03.2021 08:10

English, 18.03.2021 08:10

Biology, 18.03.2021 08:10

Mathematics, 18.03.2021 08:10

Geography, 18.03.2021 08:10

Physics, 18.03.2021 08:10