Business, 24.04.2020 22:02, jackieanguiano3700

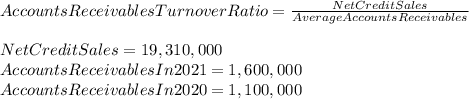

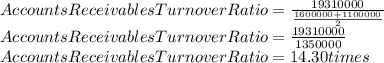

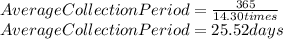

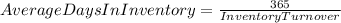

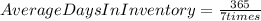

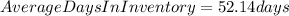

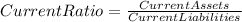

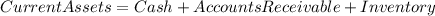

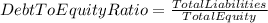

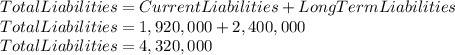

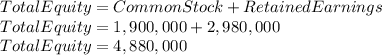

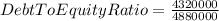

The 2021 income statement of Adrian Express reports sales of $19,310,000, cost of goods sold of $12,250,000, and net income of $1,700,000. Balance sheet information is provided in the following table. ADRIAN EXPRESS Balance Sheets December 31, 2021 and 2020 2021 2020 Assets Current assets: Cash $ 700,000 $ 860,000 Accounts receivable 1,600,000 1,100,000 Inventory 2,000,000 1,500,000 Long-term assets 4,900,000 4,340,000 Total assets $ 9,200,000 $ 7,800,000 Liabilities and Stockholders' Equity Current liabilities $ 1,920,000 $ 1,760,000 Long-term liabilities 2,400,000 2,500,000 Common stock 1,900,000 1,900,000 Retained earnings 2,980,000 1,640,000 Total liabilities and stockholders' equity $ 9,200,000 $ 7,800,000 Industry averages for the following four risk ratios are as follows: Average collection period 25 days Average days in inventory 60 days Current ratio 2 to 1 Debt to equity ratio 50% Required: 1. Calculate the four risk ratios listed above for Adrian Express in 2021. (Use 365 days in a year. Round your answers to 1 decimal place.) 2. Do you think the company is more risky or less risky than the industry average

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 20:20, alkaline27

Jing-sheng facilitated a hiring committee for his advertising company. six employees (including two managers) met together to discuss applicants and select the finalists for a copywriter position in the public relations department. although the head of public relations would have the final nod on the candidate that would ultimately be hired, the evaluative work of the committee was very important because this group would send forward those persons they believed would be good work colleagues. in setting up this type of hiring process, the head of public relations was utilizing a(n) style of leadership. a. autocraticb. free-reinc. contingentd. participative

Answers: 3

Business, 22.06.2019 07:50, sis212

Connors academy reported inventory in the 2017 year-end balance sheet, using the fifo method, as $154,000. in 2018, the company decided to change its inventory method to lifo. if the company had used the lifo method in 2017, the company estimates that ending inventory would have been in the range $130,000-$135,000. what adjustment would connors make for this change in inventory method?

Answers: 1

Business, 22.06.2019 22:20, ciara180

Which of the following is correct? a. a tax burden falls more heavily on the side of the market that is more elastic. b. a tax burden falls more heavily on the side of the market that is less elastic. c. a tax burden falls more heavily on the side of the market that is closer to unit elastic. d. a tax burden is distributed independently of the relative elasticities of supply and demand.

Answers: 1

Do you know the correct answer?

The 2021 income statement of Adrian Express reports sales of $19,310,000, cost of goods sold of $12,...

Questions in other subjects:

Mathematics, 24.08.2019 22:30

Mathematics, 24.08.2019 22:30

Mathematics, 24.08.2019 22:30

Physics, 24.08.2019 22:30

Mathematics, 24.08.2019 22:30

%

%