Business, 21.04.2020 05:15, liquidmana42

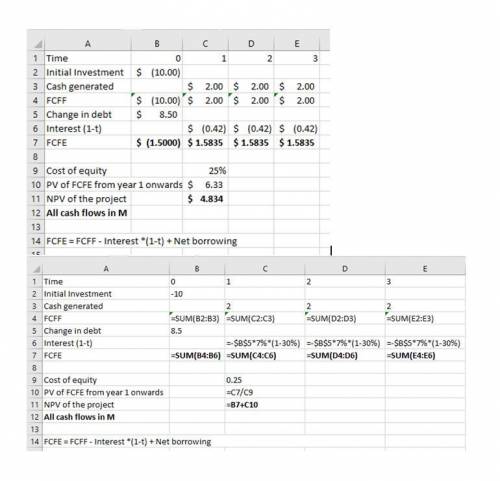

You work for First Bank of Texas, a regional bank that operates in the Houston area. The bank is thinking about expanding into Louisiana. This expansion will require an investment of $10M in free cash flows today, but will generate $2M in free cash flows every year forever. Financing for the expansion will consist of 10% equity and 90% debt. You use CAPM to estimate your cost of equity to be 25%, and this will be stable over time. Your cost of debt, however, is difficult to estimate—your debt consists of deposits, long-term debt, short-term debt, investment grade debt, and debt with different levels of collateral. However, you do know how much your debt will change over time, and the amount of your interest payments. To finance the project, you will issue a total of $8.5M in debt today, and this debt will stay constant. You will also need to make interest payments of 7% every year forever on the $8.5M in debt. You will also need to make interest payments of 7% every year forever on the $8.5M in debt. Your tax rate is 30%.What is the FCFE at time 0 (i. e. today)? (Hint: Since you just issued the debt, the interest payment at time 0 is simply zero.)A.+$1.5MB.+$1.0MC.-$1.0MD.-$1 .5M

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 16:00, hunterbetterton1

Straight arrow unloaded two tankers worth of toxic waste at an important port in the country of urithmea. a hundred workers worked two days in their shorts and sandals to unload the barrels from the tankers for $5 a day. they were not told about the content of the barrels. some observers felt that it was the obligation of not just the government of urithmea but also of straight arrow to ensure that no harm was done to the workers. these observers are most likely

Answers: 2

Business, 22.06.2019 20:00, javonteoshamccaliste

Lillypad toys is a manufacturer of educational toys for children. six months ago, the company's research and development division came up with an idea for a unique touchscreen device that can be used to introduce children to a number of foreign languages. three months ago, the company produced a working prototype, and last month the company successfully launched its new device on the commercial market. what should lillypad's managers prepare for next? a. increased competition from imitators b. a prolonged period of uncontested success c. a sharp decline in demand for the product d. a difficult struggle to move from invention to innovation

Answers: 2

Business, 22.06.2019 22:40, jonlandis6

The year is 2278, and the starship enterprise is running low on dilithium crystals, which are used to regulate the matter-antimatter reactions that propel the ship across the universe. without the crystals, space-time travel is not possible. if there is only one known source of dilithium crystals, the necessary conditions for a monopoly are met. part 2 (1 point)see hint if the crystals are government owned or government regulated, and the government wants to create the greatest welfare for society, then it should set the price choose one or more: a. so only the rich can afford space-time travel. b. at the profit-maximizing price. c. at the efficient price. d. using the marginal-cost pricing rule. e. so everyone can afford space-time travel. f. at the monopoly price.

Answers: 1

Do you know the correct answer?

You work for First Bank of Texas, a regional bank that operates in the Houston area. The bank is thi...

Questions in other subjects:

Mathematics, 20.02.2020 08:58

Mathematics, 20.02.2020 08:58

English, 20.02.2020 08:58

History, 20.02.2020 08:58