Business, 21.04.2020 04:46, HoodieHeem

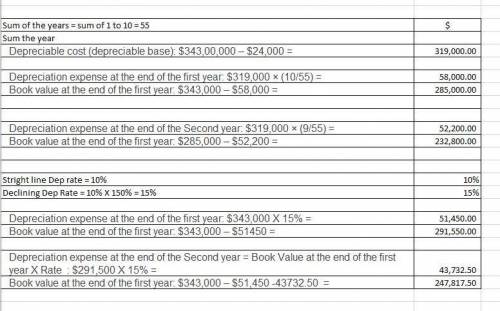

On January 1, 2021, the Allegheny Corporation purchased equipment for $343,000. The estimated service life of the equipment is 10 years and the estimated residual value is $24,000. The equipment is expected to produce 296,000 units during its life.

Required:

Calculate depreciation for 2021 and 2022 using each of the following methods.

1. Sum-of-the-years’-digits (Do not round intermediate calculations. Round final answers to the nearest whole dollar amount.)

2. One hundred fifty percent declining balance. (Round final answers to the nearest whole dollar amount.)

3. Assume instead the equipment was purchased on October 1, 2021. Calculate depreciation for 2021 and 2022 using each of the two methods. Partial-year depreciation is calculated based on the number of months the asset is in service. (Do not round intermediate answers and round your answers to the nearest whole dollar amount.)

Answers: 2

Other questions on the subject: Business

Business, 21.06.2019 22:30, lejeanjamespete1

What is the connection between digital transformation and customer experience

Answers: 2

Business, 22.06.2019 01:00, lin550

Throne technical university is looking for three people to work in its plant-biology laboratory. the hiring manager is finding that the most suitable job candidates live in other countries and are not willing to move to the city where the university is located. which situation is the university facing? a. lack of flexible workforce b. surpluses in labor talent c. an appearance of quota systems d. deficits in minimum wage demands

Answers: 1

Business, 23.06.2019 14:30, epicness5815

You received to create an urgent presentation with predesigned and preinstalled elements. which option will you use?

Answers: 2

Do you know the correct answer?

On January 1, 2021, the Allegheny Corporation purchased equipment for $343,000. The estimated servic...

Questions in other subjects:

English, 09.09.2020 22:01

Mathematics, 09.09.2020 22:01