Business, 18.04.2020 04:54, destinyycooper

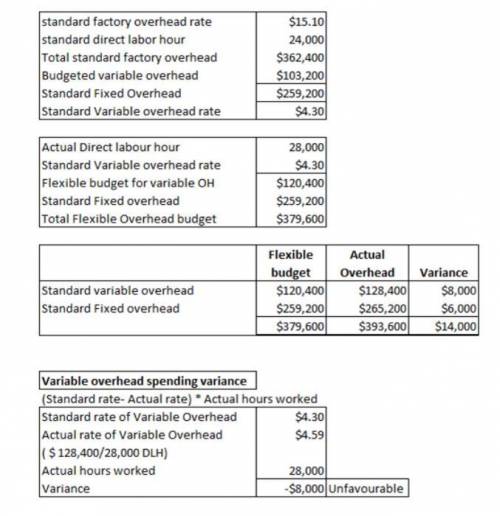

Bluecap Co. uses a standard cost system and flexible budgets for control purposes. The following budgeted information pertains to 2019:

Denominator volume-number of units 8,000

Denominator volume-percent of capacity 80%

Denominator volume-standard direct labor hours 24,000

Budgeted variable factory overhead cost at the denominator volume $103,200

Total standard factory overhead rate per direct labor hour $15.10

During 2019, Bluecap worked 28,000 direct labor hours and manufactured 9,600 units. The actual factory overhead was $14,000 greater than the flexible budget amount for the units produced, of which $6,000 was due to fixed factory overhead. In preparing a budget for 2020 Jensen decided to raise the level of operation to 90% of capacity, to manufacture 9,000 units at a budgeted total of 27,000 direct labor hours.

a. Compute variable overhead variances for 2019:

b. Compute fixed overhead variances for 2019:

c. Under the assumption that the total budgeted fixed overhead for 2020 is the same as it was for 2019, what is the standard fixed overhead application rate per direct labor hour for Bluecap Co. for 2019?

d. Must be done in excel and show all work.

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 11:00, roseemariehunter12

In each of the following cases, find the unknown variable. ignore taxes. (do not round intermediate calculations and round your answers to the nearest whole number, e. g., 32.) accounting unit price unit variable cost fixed costs depreciation break-even 20,500 $ 44 $ 24 $ 275,000 $ 133,500 44 4,400,000 940,000 8,000 75 320,000 80,000

Answers: 3

Business, 22.06.2019 11:30, laylay120

You've arrived at the pecan shellers conference—your first networking opportunity. naturally, you're feeling nervous, but to avoid seeming insecure or uncertain, you've decided to a. speak a little louder than you would normally. b. talk on your cell phone as you walk around. c. hold an empowered image of yourself in your mind. d. square your shoulders before entering the room.

Answers: 2

Business, 22.06.2019 17:00, adrianbanuelos1999

Cooper sues company a in state court in south carolina, where he lives, for negligence alleging personal injury and property damage of $100,000 after a truck driven by an employee of company a rear-ended his pickup truck. company a is incorporated in delaware, has its headquarters in new york, but does a substantial amount of business in south carolina. claiming diversity of citizenship, company a seeks removal to federal district court, but cooper opposes the motion. which of the following is true regarding whether the case may be properly removed to federal district court? the amount in controversy satisfies diversity requirements; and if company a's nerve center is in a state other than south carolina, then the case may be properly removed to federal court. the amount in controversy satisfies diversity requirements; and because company a is incorporated and has its headquarters in a state other than south carolina, the case may be properly removed to federal court. because the amount in controversy satisfies diversity requirements and company a is incorporated in a state other than south carolina, the case may be properly removed to federal court regardless of where company a's headquarters, nerve center, or principal place of business is located. because the amount in controversy satisfies diversity requirements and company a is headquartered in a state other than south carolina, the case may be properly removed to federal court regardless of where company a is incorporated and regardless of the location of its nerve center. because the amount in controversy fails to satisfy jurisdictional requirements, regardless of the location of company a, the case may not be removed to federal court.

Answers: 1

Business, 22.06.2019 18:00, claftonaustin846

Your subscription to investing wisely weekly is about to expire. you plan to subscribe to the magazine for the rest of your life, and you can renew it by paying $85 annually, beginning immediately, or you can get a lifetime subscription for $620, also payable immediately. assuming that you can earn 6.0% on your funds and that the annual renewal rate will remain constant, how many years must you live to make the lifetime subscription the better buy?

Answers: 2

Do you know the correct answer?

Bluecap Co. uses a standard cost system and flexible budgets for control purposes. The following bud...

Questions in other subjects:

Mathematics, 20.04.2021 21:10

Mathematics, 20.04.2021 21:10

Mathematics, 20.04.2021 21:10

Mathematics, 20.04.2021 21:10

Mathematics, 20.04.2021 21:10