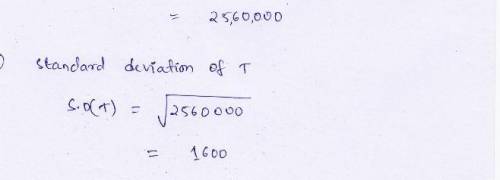

Problem 3.15 page 37 Consider an economy with a flat rate tax system Each dollar of income over $5000 is taxed at 20 Income below $5000 is tax free In general T 2 Y 5000 1000 2Y where T is taxes and Y is income Suppose that the population mean income is $20000 and that the population standard deviation of incomes is $8000 All families have at least $5000 of income a find the mean of T b

Find the standard deviation of T c If the population contains 20 million families what is the government s total tax revenue

Answers: 2

Other questions on the subject: Business

Business, 21.06.2019 14:00, thelordoftheknowwjo4

Forty-two percent of federal revenue comes from . income taxes paid by businesses and corporations make up about of federal revenue. taxes collected for social security and medicare make up of federal revenue.

Answers: 1

Business, 22.06.2019 07:40, genyjoannerubiera

Xyz corporation has provided the following data concerning manufacturing overhead for july: actual manufacturing overhead incurred $ 69,000 manufacturing overhead applied to work in process $ 79,000 the company's cost of goods sold was $243,000 prior to closing out its manufacturing overhead account. the company closes out its manufacturing overhead account to cost of goods sold. which of the following statements is true? multiple choice manufacturing overhead was overapplied by $10,000; cost of goods sold after closing out the manufacturing overhead account is $253,000 manufacturing overhead was underapplied by $10,000; cost of goods sold after closing out the manufacturing overhead account is $233,000 manufacturing overhead was underapplied by $10,000; cost of goods sold after closing out the manufacturing overhead account is $253,000 manufacturing overhead was overapplied by $10,000; cost of goods sold after closing out the manufacturing overhead account is $233,000

Answers: 1

Business, 22.06.2019 12:30, cuppykittyy

Acorporation a. can use different depreciation methods for tax and financial reporting purposes b. must use the straight - line depreciation method for tax purposes and double declining depreciation method financial reporting purposes c. must use different depreciation method for tax purposes, but strictly mandated depreciation methods for financial reporting purposes d. can use straight- line depreciation method for tax purposes and macrs depreciation method financial reporting purposes

Answers: 2

Business, 22.06.2019 14:30, 20guadalupee73248

The face of a company is often that of the lowest paid employees who meet the customers. select one: true false

Answers: 1

Do you know the correct answer?

Problem 3.15 page 37 Consider an economy with a flat rate tax system Each dollar of income over $500...

Questions in other subjects:

Mathematics, 20.07.2021 01:00

Health, 20.07.2021 01:00