Business, 16.04.2020 00:25, jagdeep5533

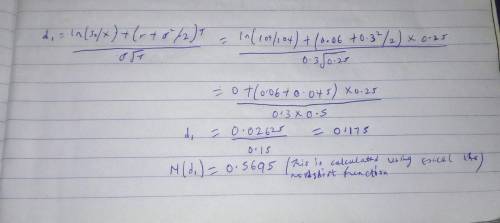

Suppose that call options on ExxonMobil stock with time to expiration 3 months and strike price $104 are selling at an implied volatility of 28%. ExxonMobil stock currently is $104 per share, and the risk-free rate is 6%. If you believe the true volatility of the stock is 30%. a. If you believe the true volatility of the stock is 30%, would you want to buy or sell call options? Buy call options Sell call options b. Now you need to hedge your option position against changes in the stock price. How many shares of stock will you hold for each option contract purchased or sold? (Round your answer to 4 decimal places.)

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 11:10, flippinhailey

Suppose that the firm cherryblossom has an orchard they are willing to sell today. the net annual returns to the orchard are expected to be $50,000 per year for the next 20 years. at the end of 20 years, it is expected the land will sell for $30,000. calculate the market value of the orchard if the market rate of return on comparable investments is 16%.

Answers: 1

Business, 22.06.2019 11:50, ayoismeisalex

Select the correct answer. ramon applied to the state university in the city where he lives, but he was denied admission. what should he do now? a. change his mind about graduating and drop out of high school so he can start working right away. b. decide not to go to college, because he didn’t have a backup plan. c. stay positive and write a mean letter to let the college know that they made a bad decision. d. learn from this opportunity, reevaluate his options, and apply to his second and third choices.

Answers: 2

Do you know the correct answer?

Suppose that call options on ExxonMobil stock with time to expiration 3 months and strike price $104...

Questions in other subjects:

Mathematics, 18.09.2020 08:01

Mathematics, 18.09.2020 08:01

Mathematics, 18.09.2020 08:01

Mathematics, 18.09.2020 08:01

English, 18.09.2020 08:01

Mathematics, 18.09.2020 08:01

Mathematics, 18.09.2020 08:01

English, 18.09.2020 08:01

Mathematics, 18.09.2020 08:01

Mathematics, 18.09.2020 08:01