Business, 15.04.2020 23:31, sheyenne143

Laserwords Inc. is a book distributor that had been operating in its original facility since 1987. The increase in certification programs and continuing education requirements in several professions has contributed to an annual growth rate of 15% for Laserwords since 2012. Laserwords’ original facility became obsolete by early 2017 because of the increased sales volume and the fact that Laserwords now carries CDs in addition to books.

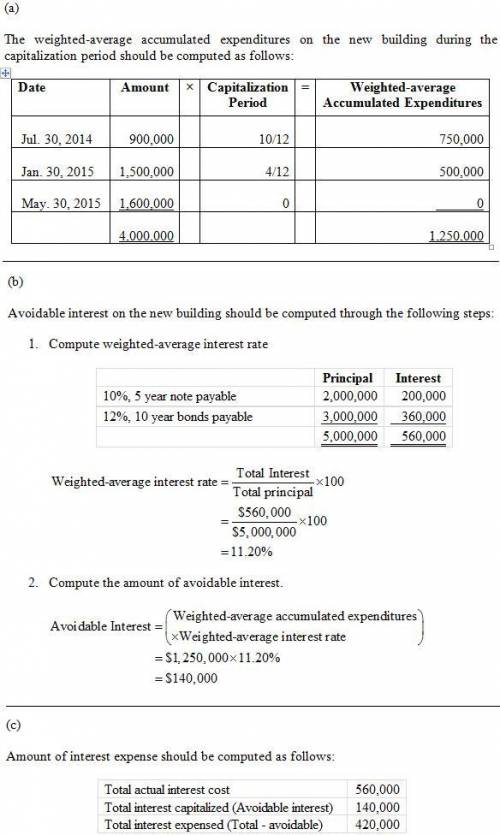

On June 1, 2017, Laserwords contracted with Black Construction to have a new building constructed for $4,000,000 on land owned by Laserwords. The payments made by Laserwords to Black Construction are shown in the schedule below.

Date

Amount

July 30, 2017

$900,000

January 30, 2018

1,500,000

May 30, 2018

1,600,000

Total payments

$4,000,000

Construction was completed and the building was ready for occupancy on May 27, 2018. Laserwords had no new borrowings directly associated with the new building but had the following debt outstanding at May 31, 2018, the end of its fiscal year.

10%, 5-year note payable of $2,000,000, dated April 1, 2014, with interest payable annually on April 1.

12%, 10-year bond issue of $3,000,000 sold at par on June 30, 2010, with interest payable annually on June 30.

The new building qualifies for interest capitalization. The effect of capitalizing the interest on the new building, compared with the effect of expensing the interest, is material.

A. Compute the weighted-average accumulated expenditures on Laserwords’s new building during the capitalization period.

B Calculate Weighted-Average Interest Rate

C: Calculate Avoidable Interest

Answers: 3

Other questions on the subject: Business

Business, 21.06.2019 17:00, santos200154

The typical consumer's food basket in the base year 2015 is as follows: 30 chickens at $4 each 10 hams at $5 each 10 steaks at $8 each a chicken feed shortage causes the price of chickens to rise to $5.00 each in the year 2016. hams rise to $7.00 each, and the price of steaks is unchanged. a. calculate the change in the "cost-of-eating" index between 2015 and 2016. year cost of the basket 2015 $ 2016 $ instructions: enter your responses rounded to one decimal place. the official cost-of-eating index has by %. b. suppose that consumers are completely indifferent between two chickens and one ham. for this example, how large is the substitution bias in the official "cost-of-eating" index? the in the cost-of-eating index is %. the of inflation in the cost of eating reflects substitution bias.

Answers: 3

Business, 21.06.2019 21:20, sophiaa23

Reqwest llc agrees to sell one hundred servers to social media networks, inc. the servers, which social media networks expressly requires to have certain amounts of memory, are to be shipped “f. o.b. social media networks distribution center in tampa, fl.” when the servers arrive, social media networks rejects them and informs reqwest, claiming that the servers do not conform to social media networks’ memory requirement. a few hours later, the servers are destroyed in a fire at social media networks’ distribution center. will reqwest succeed in a suit against social media networks for the cost of the goods?

Answers: 3

Business, 21.06.2019 21:30, dondre54

The following balance sheet for the los gatos corporation was prepared by a recently hired accountant. in reviewing the statement you notice several errors. los gatos corporation balance sheet at december 31, 2018 assets cash $ 44,000 accounts receivable 86,000 inventories 57,000 machinery (net) 122,000 franchise (net) 32,000 total assets $ 341,000 liabilities and shareholders' equity accounts payable $ 54,000 allowance for uncollectible accounts 7,000 note payable 59,000 bonds payable 112,000 shareholders' equity 109,000 total liabilities and shareholders' equity $ 341,000 additional information: cash includes a $22,000 restricted amount to be used for repayment of the bonds payable in 2022. the cost of the machinery is $194,000. accounts receivable includes a $22,000 note receivable from a customer due in 2021. the note payable includes accrued interest of $7,000. principal and interest are both due on february 1, 2019. the company began operations in 2013. income less dividends since inception of the company totals $37,000. 52,000 shares of no par common stock were issued in 2013. 200,000 shares are authorized. required: prepare a corrected, classified balance sheet. (amounts to be deducted should be indicated by a minus sign.)

Answers: 2

Business, 22.06.2019 09:50, winterblanco

phillips, inc. had the following financial data for the year ended december 31, 2019. cash $ 41,000 cash equivalents 75,000 long term investments 59,000 total current liabilities 149,000 what is the cash ratio as of december 31, 2019, for phillips, inc.? (round your answer to two decimal places.)

Answers: 3

Do you know the correct answer?

Laserwords Inc. is a book distributor that had been operating in its original facility since 1987. T...

Questions in other subjects:

Mathematics, 17.09.2020 14:01

Mathematics, 17.09.2020 14:01

Mathematics, 17.09.2020 14:01

Mathematics, 17.09.2020 14:01

Mathematics, 17.09.2020 14:01

Mathematics, 17.09.2020 14:01

Mathematics, 17.09.2020 14:01

Mathematics, 17.09.2020 14:01

Mathematics, 17.09.2020 14:01

History, 17.09.2020 14:01