Business, 15.04.2020 15:32, Madalyngarcia20

1.Lionel is an unmarried law student at State University Law School, a qualified educational institution. This year Lionel borrowed $24,000 from County Bank and paid interest of $1,440. Lionel used the loan proceeds to pay his law school tuition. Calculate the amounts Lionel can deduct for higher education expenses and interest on higher education loans under the following circumstances:

Lionel's AGI before deducting interest on higher education loans is $74,000.

(1) Modified AGI $ 74,000

(2) Amount of interest paid up to $2,500 1,440 Lesser of amount paid or $2,500

(3) Phase-out (reduction) percentage 60 % [(1) − 65,000]/15,000,limited to 100 percent

(4) Phase-out amount (reduction in maximum) 864 (2) × (3)

Deductible interest expense $ 576 (2) − (4)

2.This year Jack intends to file a married-joint return with two dependents. Jack received $162,500 of salary and paid $5,000 of interest on loans used to pay qualified tuition costs for his dependent daughter, Deb. This year Jack has also paid qualified moving expenses of $4,300 and $24,000 of alimony.

What is Jack's adjusted gross income? Assume that Jack will opt to treat tax items in a manner to minimize his AGI.

AGI is $132,050. Jack's modified AGI calculated without adjustment for educational interest expense is 134,200. He is allowed to deduct part of his student loan interest because his modified AGI is not above $160,000. Jack's maximum deduction before the phase-out is $2,500 (the amount of interest paid up to $2,500). The maximum deduction of $2,500 is phased-out ratably over a $30,000 range beginning with modified AGI over $130,000. Consequently, Jack’s education interest expense deduction is $2,150 = ($2,500 − $2,500 × [($134,200 − 130,000)/30,000]). Jack’s AGI is computed as follows;

Salary and gross income $ 162,500

Less: Alimony – 24,000

Moving expense deduction – 4,300

Modified AGI $ 134,200

Student loan interest deduction – 2,150

AGI $ 132,050

my question:

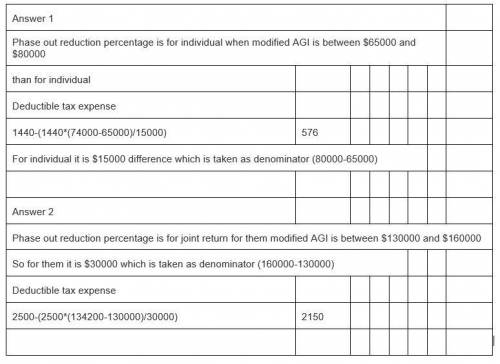

On Question 1 : [(1) − 65,000]/15,000,limited to 100 percent

On Question 2: ($2,500 − $2,500 × [($134,200 − 130,000)/30,000])

Why 15,000 on question 1 , compared to 30,000 on question 2?

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 18:00, flowergirly34

Martha entered into a contract with terry, an art dealer. according to the contract, terry was to supply 18 th century artifacts to martha for the play she was directing, and martha was ready to pay $50,000 for this. another director needed the same artifacts and was ready to pay $60,000. terry decided not to sell the artifacts to martha. in this case, the court may order terry to:

Answers: 2

Business, 22.06.2019 18:30, saneayahsimmons

What historical context does wiesel convey using the allusion of a fiery sky? he compares the sky to hell. the fires from air raids during world war ii the cremation of jews in the concentration camps the outbreak of forest fires from bombs in world war ii

Answers: 1

Business, 22.06.2019 19:20, Gabby2581

Win goods inc. is a large multinational conglomerate. as a single business unit, the company's stock price is estimated to be $200. however, by adding the actual market stock prices of each of its individual business units, the stock price of the company as one unit would be $300. what is win goods experiencing in this scenario? a. diversification discount b. learning-curveeffects c. experience-curveeffects d. economies of scale

Answers: 1

Business, 22.06.2019 22:20, jaylaa04

Which of the following best explains why the demand for housing is more flexible than the supply? a. new housing developments are being constructed all the time. b. low interest rates for mortgages make buying a home very affordable. c. the increasing population always drives demand upwards. d. people can move more easily than producers can build new homes.

Answers: 1

Do you know the correct answer?

1.Lionel is an unmarried law student at State University Law School, a qualified educational institu...

Questions in other subjects:

Mathematics, 11.05.2021 01:00

Geography, 11.05.2021 01:00

Biology, 11.05.2021 01:00